The Evolution of Private Equity in the Tech Industry

Historical Context and Rise of Tech-Focused Private Equity

Historically, the private equity landscape has been a dynamic and evolving field, with its roots deeply embedded in traditional industries such as manufacturing and retail. Over the past few decades, however, there has been a clear shift towards the technology sector as a fertile ground for investments. This evolution has been driven by the rapid pace of technological advancements and the increasing significance of tech-driven business models. As the digital era gained momentum, private equity firms recognized the transformative potential of technology and began to pivot their strategies to capitalize on emerging tech opportunities.

Tech-focused private equity firms emerged as specialized investors, equipped to navigate the complexities of the tech sector and harness its growth potential. These firms possess a deep understanding of the unique characteristics and value propositions of tech companies, allowing them to implement effective growth strategies and operational enhancements. The evolution of private equity into the tech industry heralded a new era of strategic investments, where technological innovation became a key driver of value creation and scalability.

Market Dynamics Driving Tech Investments

The surge in tech investments by private equity firms can be attributed to several market dynamics and trends. Key among these is the increasing demand for digital transformation across industries, fueled by the need to remain competitive and relevant in a technology-driven world. As businesses seek to optimize operations and enhance customer experiences, technology solutions have become imperative for success. Private equity firms capitalize on this demand, investing in tech companies that offer scalable solutions to address these challenges.

Moreover, the proliferation of data and the rise of analytics have significantly impacted investment strategies. Portfolio Company Exit Preparation Technologies to Enhance Valuation highlights how technologies like AI-driven analytics offer insights that enhance customer retention, increase revenue, and boost valuations. These insights allow private equity firms to make informed decisions, driving both short and long-term growth for their portfolio companies.

As private equity firms continue to leverage technology for strategic growth, the next section will delve deeper into understanding the nuances of technology private equity firms, their defining characteristics, and key players in the market.

Understanding Technology Private Equity Firms

Defining Characteristics and Differences from Venture Capital

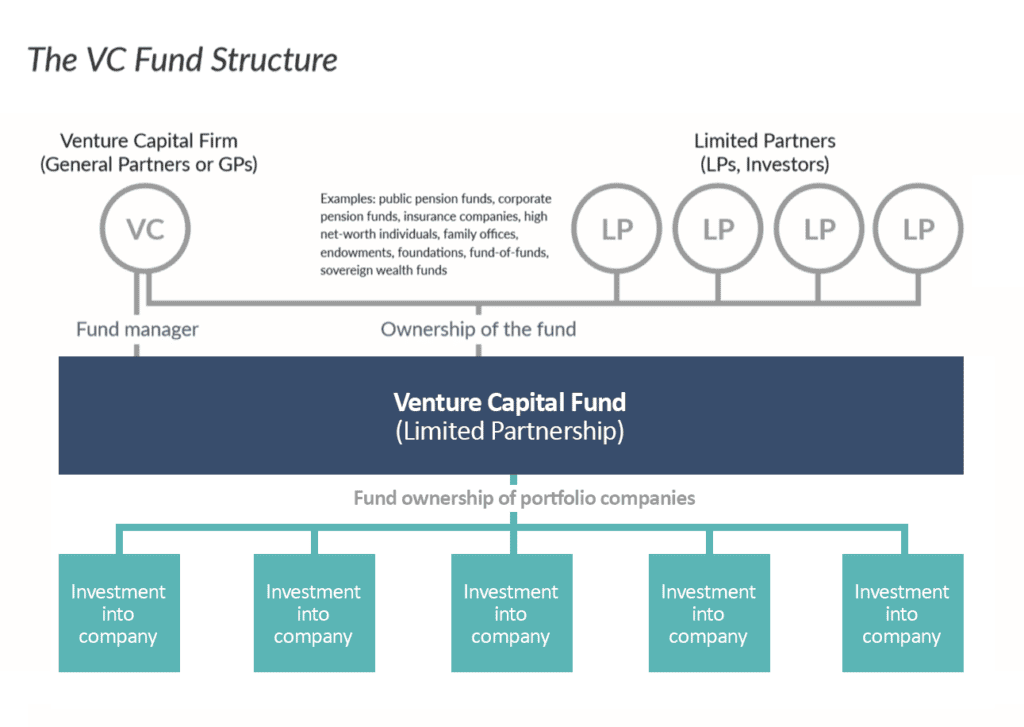

Technology private equity firms are often distinct from venture capital in their operational strategies and objectives. While venture capital typically focuses on early-stage startups, technology private equity firms invest in more mature companies with the aim of scaling them into market leaders. This growth involves strategic interventions such as improving operational efficiencies, expanding market presence, and leveraging technological advancements.

Private equity firms in the technology sector are characterized by their focus on enhancing business value through technology integration. They often employ technologies such as AI and machine learning to optimize operations, predict market trends, and create strategic advantages. An integral aspect of these firms is “Better Information. Better Decisions. Better Outcomes,” which underlines their approach to driving value creation through informed decision-making, as quoted in the document “Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research.”

Compared to venture capital firms, which might provide minimal oversight, technology private equity firms are usually hands-on, working closely with a company’s management to enhance value. This often involves restructuring initiatives, optimization processes, and sometimes appointing new leadership to pursue new strategic directions.

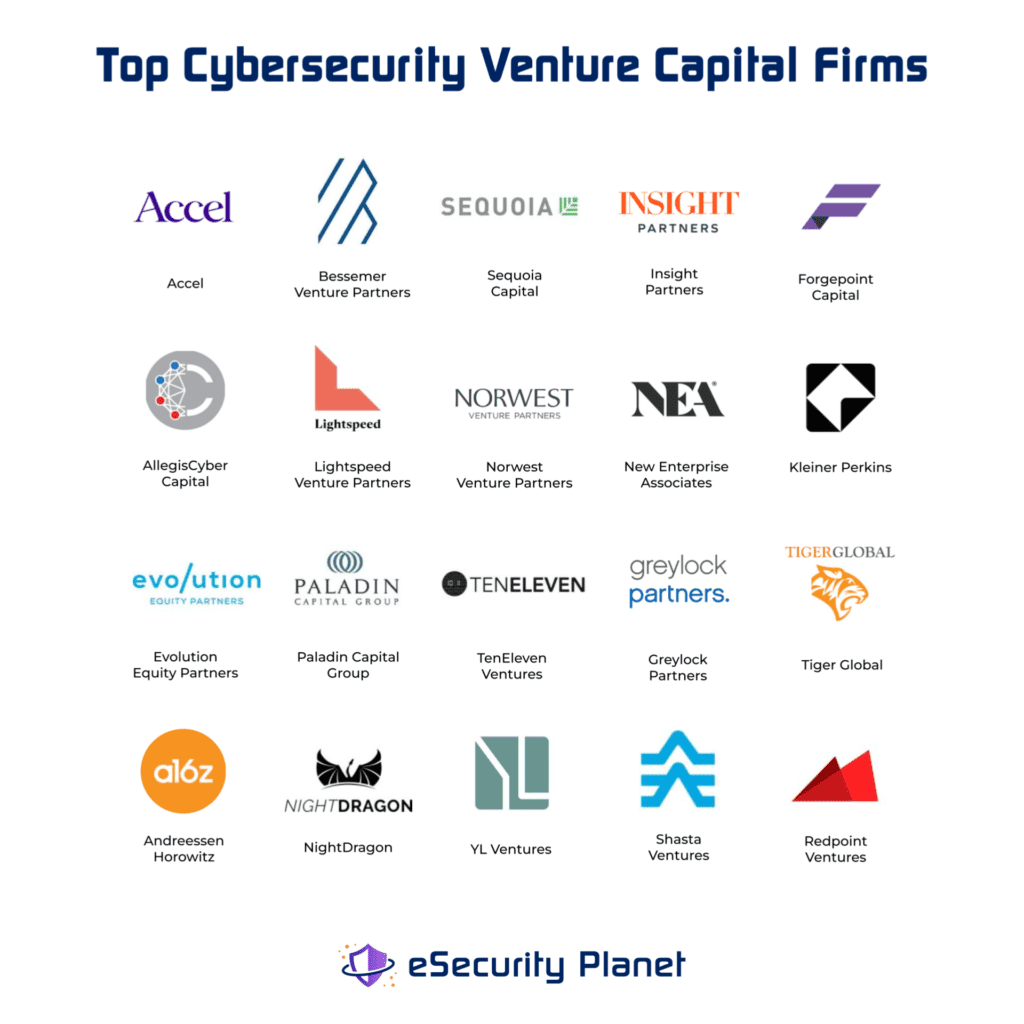

Key Players in the Market

The space of technology private equity is populated by a few key players known for their significant influence and investment in tech-driven transformations. These firms are known not just for their financial capabilities but also for their strategic leverage in technology implementation. They invest heavily in areas such as AI, cybersecurity, and data analytics to enhance the value of their portfolio companies effectively.

Global firms with a strong presence in hub cities like Palo Alto, Boston, London, and Tel Aviv, exemplify this type of investment strategy, as indicated in data quoted from the document “Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research.” These firms are not only catalysts for growth but also innovators in aligning technology with traditional business models to achieve strategic growth.

As we transition to the next section, we delve into the specific technological innovations that enhance company valuations, underscoring the role of AI and cybersecurity, fundamental in shaping investment strategies and protecting intellectual property respectively.

Technological Innovations Enhancing Valuation

AI-Driven Value Creation Strategies

Artificial intelligence (AI) has become a transformative force in private equity, driving substantial value creation across various dimensions. AI-driven strategies can significantly enhance the valuation of portfolio companies by optimizing operations and enabling data-driven decision-making. These strategies are not only about leveraging AI for current operations but also for crafting future growth avenues.

One of the most impactful applications of AI is in sales and marketing. AI-powered tools such as “AI agents and analytics tools reduce Customer Acquisition Cost (CAC), enhance close rates by 32%, and increase revenue by 50%.” These improvements represent significant value creation opportunities by maximizing sales efficiency and boosting revenue.

The use of AI extends to customer retention and satisfaction as well. AI-based platforms streamline customer success tasks, resulting in “up to a 25% increase in market share and a 20% revenue increase by acting on customer feedback.” Such metrics enhance the enterprise’s valuation by forecasting predictable and sustainable revenue streams.

Additionally, AI offers significant enhancements in operational efficiency. For instance, predictive maintenance and process automation can lead to a “30% increase in production output,” consequently reducing costs and enhancing the overall valuation.

Protecting Intellectual Property and Data with Cybersecurity

Another critical aspect of technological innovation enhancing valuation is cybersecurity. Protecting a company’s intellectual property (IP) and sensitive data is essential in today’s digital age. Cybersecurity protocols not only secure a company’s innovative edge but also build trust with investors and clients. As highlighted in the Portfolio Company Exit Preparation Technologies to Enhance Valuation, various frameworks such as ISO 27002, SOC 2, and NIST are instrumental in “defending against value-eroding breaches,” which further boosts buyer trust and readiness for acquisition.

Implementing strong cybersecurity measures ensures the protection of critical data and intellectual property, providing a safeguard against potential cyber threats. This protection is crucial as the risks of cyberattacks increase with the digitalization of business processes, potentially affecting a company’s brand value and limiting future growth if not appropriately safeguarded.

As technological innovations continue to reshape how private equity firms operate, the focus not only remains on enhancing valuation but also on preparing for successful exits.

Portfolio Company Exit Preparation Technologies

Private equity firms have come to understand the critical role that technology plays in preparing portfolio companies for successful exits. This preparation not only focuses on enhancing the company’s operational efficiency but also on strengthening factors that appeal to potential buyers, ultimately maximizing the valuation at exit.

Strategies to Increase Valuation at Exit

Enhancing a company’s valuation before exit requires a multi-faceted approach, where technology is a robust enabler. Technologies such as AI-powered analytics and customer sentiment tools provide insights that formulate growth strategies effectively. “GenAI analytics and success platforms increase LTV, reduce churn (-30%), and increase revenue (+20%). GenAI call centre assistants boost upselling and cross-selling by (+15%) and increase customer satisfaction (+25%).” This shows that understanding customer behavior and tailoring services can significantly boost company metrics before an exit.

Moreover, IP and data protection technologies are indispensable in this process. Implementing frameworks like ISO 27002, SOC 2, and NIST safeguards against data breaches, crucial for maintaining company valuation. “Compliance readiness boosts buyer trust,” ensuring that private equity firms can offer a more secure investment to prospective buyers. Software IP protection is a vital aspect of this strategy.

Case Studies on Successful Exits

The deployment of innovative technology solutions has resulted in successful exits for various portfolio companies. These case studies highlight the impact of strategic technology integration in achieving optimal sale conditions. By leveraging AI and predictive analytics, firms have witnessed significant improvements in operational areas such as sales, customer retention, and process automation, leading to increased buyer interest and competitive sale offers.

As we venture into the geographical hubs where private equity activity is burgeoning, understanding the local technology landscape and its unique growth potential becomes crucial for making informed investment decisions.

Geographical Hubs of Tech Private Equity Activity

Tech-Focused Private Equity Firms in Silicon Valley

Silicon Valley continues to be a dominant hub for tech private equity activity due to its rich ecosystem of tech startups and innovators. The concentration of top-tier talent, proximity to major tech companies, and a culture of innovation make it a fertile ground for private equity firms looking to invest in cutting-edge technologies. As a result, Silicon Valley remains attractive for its robust network of venture capital, offering opportunities for partnerships and strategic acquisitions. The synergy between academia, entrepreneurship, and venture capital in Silicon Valley fuels a thriving environment for technology-focused private equity investments.

Emerging Markets and Global Expansion

While Silicon Valley continues to lead, emerging markets are increasingly becoming hotspots for tech private equity activity. Cities like Tel Aviv, known for its cybersecurity expertise, and Ho Chi Minh City, which is rapidly developing in the tech sector, are drawing attention from global investors. These regions offer unique opportunities to capitalize on local talent and innovations that are often underrepresented in traditional markets. Private equity firms are also actively exploring regions like Dublin and Istanbul, which are gaining traction as emerging tech hubs due to favorable regulatory environments and supportive government policies.

The diversification of tech private equity activity across these geographical hubs demonstrates an increasing trend towards global expansion. As firms look beyond traditional markets, the potential for strategic growth through investment in technology becomes evident with examples like establishing a presence in “Palo Alto, Tel Aviv, and Dublin” to tap into new opportunities and innovations (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

In the following section, we’ll delve into the key outcomes of leveraging technology-driven valuation enhancements to further illustrate the strategic growth dynamics within the private equity landscape.

Key Outcomes of Technology-Driven Valuation Enhancements

As private equity firms continue to embrace technology to elevate their portfolio companies, the outcomes have been profoundly transformative, driving growth and enhancing valuation in multiple dimensions. Two critical outcomes of technology-driven valuation enhancements include revenue growth and cost reduction, each contributing significantly to the overall success of private equity investments.

Revenue Growth Through Smart Tech Investments

The integration of advanced technologies such as AI-driven sales agents, product recommendation engines, and dynamic pricing software has unlocked substantial revenue growth opportunities. For instance, AI sales agents have been known to reduce manual sales tasks by 40-50% and cut down sales cycle times by 40%, leading to a 50% increase in revenue (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”). Furthermore, companies adopting these technologies have seen an approximate 25-30% boost in upselling and cross-selling efforts, enhancing market share by as much as 25% (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”).

Personalized engagement through product recommendation engines has also contributed significantly by increasing cross-sell conversion rates by up to 30% for B2C markets. Additionally, dynamic pricing software has led to an average 30% increase in order value, demonstrating the powerful impact of data-informed pricing strategies on revenue targets.

Cost Reduction and Efficiency Gains

On the cost reduction front, the implementation of AI and other technologies in manufacturing and operational workflows has resulted in remarkable efficiency improvements. For example, the use of additive manufacturing techniques has driven a 60-70% reduction in manufacturing costs while improving production output by 30% (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”). Furthermore, the deployment of predictive maintenance and lights-out factory systems has slashed maintenance costs by 40%, extended machine lifetimes by 20-30%, and halved unplanned machine downtime events. These improvements exemplify how technology not only reduces operational expenditures but also strengthens a company’s competitive positioning through enhanced production capabilities.

Overall, tech-enabled cost reductions contribute to leaner operations and higher profit margins, which are crucial factors for increasing a portfolio company’s valuation. Such advancements allow private equity firms to achieve lucrative exits by presenting a highly efficient and scalable business model to potential buyers.

Next, we delve into the future trends shaping the landscape of technology in private equity. As we explore the evolving role of AI and predictive analytics, we uncover emerging opportunities and paradigm shifts that continue to redefine investment strategies.

Future Trends in Technology Private Equity

The landscape of technology private equity is continuously evolving, stimulated by rapid technological advancements and emerging market opportunities. As private equity firms look to harness technology to enhance growth strategies, several trends are shaping the future of this dynamic sector.

Predictive Analysis of Market Shifts and Opportunities

In the future, predictive analytics is expected to play an increasingly vital role in identifying market shifts and investment opportunities. By leveraging big data and machine learning algorithms, private equity firms can gain foresight into market trends, enabling them to make data-driven investment decisions. Predictive analytics not only helps in recognizing burgeoning sectors but also mitigates risks by forecasting potential downturns.

Role of AI in Shaping Investment Strategies

Artificial Intelligence (AI) continues to transform investment strategies within private equity firms. AI technologies are being used to streamline due diligence processes, automate routine tasks, and provide actionable insights. Moreover, AI’s ability to simulate market scenarios allows firms to better prepare for various market conditions. With AI-driven tools, firms can enhance portfolio management efficiency and improve returns by optimizing operational processes.

“Predictive maintenance and lights-out factories” are examples of how technology not only boosts “efficiency (+30%)” but also reduces downtime “(-50%), and extends machine lifetime by 20-30%” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”). Such advancements underline AI’s potential to revolutionize operational capabilities and influence investment decisions.

As private equity firms continue to leverage technology, the implications for valuation enhancement are profound. Cutting-edge technologies promise not only to streamline operations but also to unlock new revenue streams and reduce costs. The integration of AI and data analytics will be central to these evolutionary strategies, poised to redefine the industry landscape.

In the next section, we will delve deeper into how these technological innovations impact geographical hubs, illuminating the regional dynamics within technology-private equity interplay.

Exploring Leading Tech Private Equity Firms: Trends and AI-Driven Innovations

The world of private equity has often been a quiet powerhouse, influencing the trajectory of entire industries while remaining behind the scenes. In recent years, however, tech private equity firms have emerged as dynamic players, leveraging their expertise to drive transformative changes across the technology sector. With significant investments and strategic insights, these firms don’t just navigate trends—they help set them. The integration of artificial intelligence (AI) into their operations has become a game changer, allowing for more informed decision-making and innovative value creation strategies. According to Preqin, technology-focused private equity deals reached a record high, underscoring the vital role these firms play in the economic landscape. As we delve into the leading tech private equity firms and their AI-driven innovations, we’ll explore how they are shaping the future of technology investment, the trends they are capitalizing on, and the challenges they face in an ever-evolving market.

Understanding Technology Private Equity Firms

Defining Tech Private Equity

Technology private equity firms are specialized investment organizations that primarily focus on acquiring equity ownership in technology-centric companies. These firms provide capital to emerging and established tech companies, playing a crucial role in facilitating growth, innovation, and market expansions. By investing in a wide range of technology sectors, such as software development, semiconductor manufacturing, and IT services, tech private equity firms enable companies to leverage additional resources for scaling operations and enhancing their competitive positions in the market.

Evolution and Significance in Today’s Market

Tech private equity has evolved substantially over the past few decades, becoming an indispensable component of the technology ecosystem. Initially concentrated on niche markets, these firms have dramatically expanded their influence, becoming a driving force behind significant tech industry breakthroughs and advancements. As highlighted by recent studies, tech private equity firms are increasingly utilizing AI technologies to streamline investment processes and enhance decision-making capabilities. “AI streamlines portfolio planning and management, regulatory compliance, reporting, financial planning and forecasting” enabling firms to optimize their operational efficiencies and decision-making processes, thereby boosting overall performance. (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”)

The continuous evolution of technology private equity firms underscores their growing significance in shaping the future of the tech industry. As they adapt to market dynamics and leverage AI for value creation, they represent a pivotal influence in driving technological progression and competitiveness.

Exploring the top players in the tech private equity realm is essential for understanding the landscape of industry leaders and their transformative impact. These leading firms, categorized by regions, showcase unique strategies and standout performances, providing insight into global industry trends.

Top Players in Tech Private Equity

Leading Firms by Region

Technology private equity is a global market, with significant activity in North America, Europe, and Asia. In North America, firms such as Silver Lake Partners and Vista Equity Partners are leaders. Silver Lake, known for its focus on tech investments, manages approximately $75 billion in combined assets and has been a major player in deals involving large tech firms. Vista Equity, on the other hand, is renowned for its software and data- driven companies, managing funds that specialize in enterprise software.

Across the Atlantic, Europe is home to companies like EQT Partners and Permira. EQT Partners has a robust presence in Northern Europe and is noted for its focus on sustainability and the impact of its investments. Meanwhile, Permira stands out for its global reach and diversified portfolio, including investments in the digital sector and telecommunications.

In Asia, firms like Hillhouse Capital and GGV Capital lead the charge. Hillhouse has made significant strides in leveraging AI for investment strategies, while GGV Capital continues to invest heavily in consumer and enterprise technologies across China and the United States.

Spotlight on Notable Performers

Several key players in the tech PE sector emerge due to their innovative approaches and strategic investments. For instance, “increased market competition squeezing fees” has led to creative solutions like deploying AI for operational efficiencies, as “AI streamlines portfolio planning and management” (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”). Firms like Thoma Bravo are trailblazers in this regard, using AI to not only identify value but also enhance the portfolio companies’ performance in their sectors.

Additionally, General Atlantic demonstrates a strategic blend of supporting established tech enterprises while fostering growth in emerging markets. Their investment philosophy is aligned with future technology trends, embracing changes and innovations, especially those driven by AI.

As we delve into the evolving strategies of tech PE firms, it’s crucial to understand how these players adapt to market dynamics and technological disruptions. This naturally leads us to explore the investment strategies that are currently shaping the future of the tech private equity landscape.

Investment Strategies Shaping the Future

In the rapidly evolving landscape of tech private equity, firms are constantly adjusting and refining their investment strategies to both navigate and capitalize on new trends. These strategies are pivotal in shaping the future, driving innovations, and ensuring sustainable growth. A key factor in these strategies is the adoption of AI technologies, which are fundamentally transforming the decision-making process.

Current Market Trends

The tech private equity sector is experiencing a shift as firms increasingly focus on acquiring and scaling companies that harness disruptive technologies. Artificial intelligence, in particular, is a central theme, not only for the companies being invested in but also as a tool for the firms themselves. The focus is on leveraging AI to extract value from massive data sets, allowing for better predictive analytics and improved investment decisions.

Strategic Shifts Post-Pandemic

The COVID-19 pandemic accelerated the digitalization of many industries, prompting tech private equity firms to adjust their portfolios. There is now a strategic shift towards sectors such as remote work technologies, cybersecurity, and healthcare tech. This shift reflects the changing needs and behaviors of businesses and consumers in the post-pandemic world.

AI’s Role in Investment Decisions

Artificial intelligence is revolutionizing how private equity firms operate. By integrating AI-driven analytics, firms can enhance due diligence processes, forecast market trends, and spot lucrative opportunities. These AI applications provide critical insights that facilitate more informed investment decisions. Firms are increasingly relying on AI tools to streamline operations, reduce costs, and maximize returns.

According to an industry report, AI enables a “50% reduction in cost per account” and significantly reduces the time financial advisors spend on routine tasks, ultimately enhancing the efficiency of investment processes (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”).

As we explore further, the next section dives into how AI is not just aiding decision-making but actively creating value within tech private equity firms, illustrating its profound impact on operational efficiency and transformative potential.

AI-Powered Value Creation in Tech PE

In the dynamic landscape of technology private equity (Tech PE), the integration of artificial intelligence (AI) is emerging as a cornerstone for value creation. Leveraging AI not only enhances operational efficiencies but also fosters innovation across the investment lifecycle. The ability to distill vast volumes of data into actionable insights allows tech PE firms to unlock new avenues for growth and profitability.

Efficiency Boosts with AI Innovations

AI-driven technologies significantly streamline various operational aspects in tech PE firms. From due diligence processes to portfolio management, AI tools allow investors to make informed decisions faster and with greater accuracy. For instance, AI enhances data processing capabilities, boosting information processing efficiency by up to 90%, as highlighted in industry research. Innovations in AI are proving indispensable for tech PE firms aiming to optimize portfolio value and ensure competitive edge.

Generative AI Transformations

As generative AI technologies advance, their application within tech PE opens up unprecedented opportunities for innovation. The transformative potential of generative AI lies in its ability to revolutionize how firms identify and capitalize on investment opportunities. By crafting new business models and uncovering emerging market trends, generative AI empowers tech PE firms to maintain a sustainable competitive advantage. This shift highlights a growing recognition of AI’s role in reshaping strategic growth pathways within the industry.

“Deploying AI solutions is key to driving operational efficiency and customer satisfaction in tech PE. This strategic integration can lower management costs and enhance investment outcomes, aligning with the broader market shift towards passive management.” — Investment Services Industry Challenges & AI-Powered Solutions, D-LAB research.

As we delve into the challenges and adaptations in the tech PE landscape, understanding how firms navigate market volatility and valuation concerns becomes crucial.

Challenges and Adaptations in the Tech PE Landscape

Navigating Market Volatility and Valuation Concerns

In the fast-paced world of tech private equity, navigating market volatility and valuation concerns has become increasingly complex. High-debt environments in both the US and Europe, coupled with a growing disparity across stocks, sectors, and regions, are introducing new levels of market volatility. Furthermore, the current forward P/E ratio for the S&P 500, standing at approximately 23 compared to a historical average of 18.1, indicates potential overvaluation risks. These factors are creating “financial stress for investment firms”, as highlighted in the “Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”. Private equity firms must adapt to these challenges by leveraging AI and data analytics to make more informed investment decisions and manage risks more effectively.

Competitive Pressures and Fee Structures

Increased competition is putting pressure on traditional fee structures. Big players like Vanguard are reducing their fees, prompting other firms to follow suit. This move, alongside a shift towards passive funds, is reshaping the competitive landscape of active management. As noted in the “Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”, firms are experiencing a squeeze on fees and need to diversify their growth strategies to maintain profitability. AI is playing a crucial role in this adaptation by streamlining operations and reducing costs. Implementing AI solutions can lead to a “50% reduction in cost per account” and “10-15 hours saved per week by financial advisors”, demonstrating the potential of AI to alleviate some of the competitive pressures through increased efficiency and value-added services.

As we address these complexities, it is essential to highlight the strategies employed by leading figures in the industry. The upcoming profiles of key figures in Tech PE offer insights into how experts are leading the charge in navigating these challenges successfully.

Profiles of Tech PE Industry Leaders

Ignacio Villanueva: Disruption Analyst

Ignacio Villanueva is heralded as a visionary in disruption and value creation within the realm of technology. He possesses a powerful blend of technical expertise and a strategic mindset, enabling him to advise C-suite executives at budding tech startups. Ignacio’s tenure at Gartner provided him with “unique insights into leveraging emerging technologies for strategic growth.” A passionate advocate for Generative AI, Ignacio showcases its transformative potential to revolutionize industries, driving enduring competitive advantages for businesses. He is an alumnus of the University of Manchester with a Master’s degree in Mechatronic Engineering, achieving First Class Honours.

Professor Andy Pardoe: AI Strategist

Professor Andy Pardoe stands at the forefront of AI innovation with an impressive career spanning over three decades. Serving as a Professor of AI at the University of Warwick and as Chair of the Deep Tech Innovation Centre, he is also the entrepreneurial mind behind Informed.AI Group and AI Fund Venture Flows. A former Principal Director for AI at Accenture, Andy is celebrated as a top AI influencer and was named Technology Entrepreneur of the Year in 2023. With a comprehensive background in AI strategy and business transformation, he provides invaluable advice on leveraging AI for organizational growth and innovation.

Alejandro Boiardi: VP, Value Creation

Alejandro Boiardi brings his seasoned expertise as a technology consultant with a specialization in AI-driven solutions, including voice of customer analytics and online news processing. His collaboration with top private equity funds has seen the employment of AI, machine learning, and data science to facilitate value creation across diverse sectors. Alejandro’s projects often involve using machine learning to decode growth patterns, having developed sophisticated trading algorithms. His academic credentials include a degree in Mathematics and Physics from the University of Warwick, and he navigates his role with linguistic flair, fluent in five languages: Italian, Spanish, French, English, and Chinese.

With these industry vanguards leading the charge, the landscape of tech private equity is poised for dynamic and innovative transformations. As we venture further, let’s explore how these industry leaders and others are shaping investment strategies to harness future opportunities.

Investment Outlook and Future Directions

As tech private equity firms continue to navigate a rapidly evolving landscape, their investment outlook is being reshaped by emerging opportunities and advancements in AI technologies. The focus remains on identifying high-return areas while strategically leveraging technological innovations to drive growth and value.

Emerging Opportunities and High ROI Areas

The continuous evolution of technology has opened up new avenues for high-return investments. Key sectors like cloud computing, cybersecurity, and fintech are attracting significant attention due to their potential for robust growth and development. AI-driven solutions, such as “advisor co-pilots and investor assistants,” are proving to be worthwhile investments, offering high ROI by automating and optimizing various investment processes (Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research).

Leveraging AI for Strategic Growth

AI is not merely an operational tool but a strategic enabler in shaping the future direction of tech private equity investments. By integrating AI technologies for “automating workflows, enhancing customer satisfaction, and boosting operational efficiency,” firms can achieve substantial cost reductions and improve decision-making processes (Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research). Whether through streamlining portfolio management or offering personalized investment recommendations, AI is transforming how private equity firms maximize value and secure competitive advantages in the marketplace.

As tech private equity continues to explore these promising directions, attention must also be paid to the challenges that lie ahead. These challenges, including market volatility and competitive pressures, require strategic adaptation and innovative solutions to ensure sustainable growth and success.

Thoma Bravo’s Strategic Acquisition of SailPoint: A Deep Dive

In the evolving landscape of cybersecurity, Thoma Bravo’s acquisition of SailPoint marks a significant milestone. Thoma Bravo, a private equity firm renowned for investing in software and technology companies, announced its plan to acquire SailPoint Technologies Holdings Inc. for approximately $6.9 billion in April 2022. This strategic move underscores the growing importance of identity security in protecting organizations against cyber threats. SailPoint, a leading identity security provider, has been at the forefront of this domain, offering solutions that ensure the right individuals have appropriate access to technology resources. As security breaches become more sophisticated, the merger highlights the need for robust identity management solutions. By taking SailPoint private, Thoma Bravo aims to leverage its resources and expertise to accelerate growth and innovation, thus reshaping the future of identity security. This acquisition not only reflects the dynamic shifts within the cybersecurity industry but also poses intriguing questions about the future strategies and opportunities for both companies involved. Sources: [Reuters](https://www.reuters.com/), [TechCrunch](https://techcrunch.com/).

Understanding the Thoma Bravo-SailPoint Deal

Key Details of the Acquisition

Thoma Bravo, a renowned private equity firm specializing in software and technology, announced its strategic acquisition of SailPoint, a leader in identity security solutions, in a deal valued at $6.9 billion. This acquisition illustrates Thoma Bravo’s commitment to investing in high-growth potential companies within the technology sector. SailPoint has been a significant player in the cybersecurity landscape, providing robust identity governance solutions for enterprises. The acquisition was structured as an all-cash transaction, indicating Thoma Bravo’s strong financial backing and confidence in SailPoint’s future potential.

The $6.9 Billion Valuation: What It Means

The $6.9 billion valuation is not only a testament to SailPoint’s robust market position but also to the growing importance of identity security in today’s digital world. This valuation reflects the increasing demand for advanced cybersecurity solutions as organizations across the globe strive to protect their digital assets. The premium paid over SailPoint’s pre-announcement stock price shows the strategic importance Thoma Bravo places on expanding its portfolio into the cybersecurity domain, recognizing the potential for significant growth and innovation in this area.

As we explore further, we will delve into how Thoma Bravo’s acquisition is expected to influence SailPoint’s strategic direction and operational capabilities, particularly focusing on the transition from a public to a private entity and how Thoma Bravo’s expertise will enhance identity security solutions.

The Role of Thoma Bravo in SailPoint’s Journey

From Public to Private: Revisiting SailPoint’s Path

Thoma Bravo’s acquisition of SailPoint marked a pivotal transformation in the company’s journey, taking it from a publicly-traded entity back to a private one. This shift not only provided SailPoint with increased flexibility to pursue long-term strategies but also allowed for a more accelerated pace of innovation free from the quarterly performance pressures inherent in public markets. The transition to private ownership has facilitated a strategic focus on product development and organic growth, while also positioning SailPoint to explore potential complementary acquisitions that align with its core competencies in identity security.

Thoma Bravo’s Influence on Identity Security

With Thoma Bravo’s proven track record in the software space, their involvement has considerably amplified SailPoint’s capabilities in the identity security arena. Thoma Bravo’s strategic guidance has been instrumental in refining SailPoint’s approach to an ever-evolving digital landscape, which demands robust identity governance solutions. Their expertise has enabled SailPoint to “streamline portfolio planning and management” and implement new technologies, including AI, to improve efficiency and innovation across its operations (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”). By focusing on these areas, SailPoint continues to strengthen its leadership position and offer enhanced value to its clients.

As we continue to explore the impacts of this acquisition, the broader challenges and opportunities in the investment services industry play a crucial role in understanding the dynamic landscape in which both Thoma Bravo and SailPoint operate. Let’s delve into these industry dynamics next.

Challenges and Opportunities in the Investment Services Industry

Increased Market Competition and Fee Compression

The investment services industry is facing heightened competition driven by major players like Vanguard, who are leading the market towards lower fees. This trend is forcing other firms to reduce their fees, squeezing their profit margins. An additional layer of competition arises from the market’s growing inclination towards passive funds, a shift that further intensifies pressure on active fund managers. This environment creates a challenging landscape where maintaining profitability becomes increasingly difficult.

AI-Powered Solutions for Value Creation

Despite these challenges, there are significant opportunities for firms willing to innovate. The adoption of Artificial Intelligence (AI) offers promising solutions to these pressing issues. By streamlining operations through AI, investment services can achieve remarkable cost efficiency and improved service quality. For instance, AI technologies such as advisor co-pilots and financial coaches are helping firms reduce costs and enhance decision-making processes by improving information processing and customer interaction.”Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”.

Firms leveraging AI can not only navigate competitive pressures more effectively but also create new value by enhancing customer engagement and diversifying their product offerings. As the industry advances into a technology-driven era, embracing AI becomes a strategic imperative for thriving amidst market volatility and evolving client expectations.

Looking forward, there are additional strategies leveraging AI that deserve our attention, specifically how these technological advances are reshaping the landscape of investment services.

Leveraging AI for Strategic Advantage

In the dynamic landscape of investment services, Thoma Bravo’s acquisition of SailPoint underscores a critical strategic shift toward leveraging AI for enhanced decision-making and operational efficiency. By integrating AI-driven solutions into its operational blueprint, Thoma Bravo is poised to unlock unprecedented value both within its portfolio companies and across the investment services sector.

AI in Portfolio Planning and Management

The integration of AI in portfolio management has transformed traditional methods, offering a streamlined and data-driven approach to decision-making. AI capabilities can optimize portfolio strategies by analyzing vast data sets, identifying growth trends, and forecasting potential market shifts with increased accuracy. Utilizing AI for regulatory compliance, reporting, and financial planning can lead to a substantial reduction in operational costs—up to “50% reduction in cost per account”—and improve efficiency by “90% boost in information processing efficiency” (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”). This technological edge allows Thoma Bravo to maintain competitive pricing models and deliver superior service to its stakeholders.

Improving Client Engagement with AI Financial Coach

AI’s role extends beyond optimization into personalized client interactions. Thoma Bravo can markedly improve SailPoint’s client engagement metrics through AI-powered financial coaching. These adept AI solutions provide real-time support, offering personalized investment recommendations and educational insights. The adoption of AI financial coaches can enhance client relationships by “35% improvement in client engagement” and significantly reduce response times by “40% reduction in call centre wait times” (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”). By deploying such state-of-the-art technology, Thoma Bravo ensures that SailPoint remains a leader in delivering tailored financial advice and products.

The strategic use of AI not only solidifies SailPoint’s competitive position post-acquisition but also sets a precedent for future growth strategies. As we explore the future prospects for SailPoint, it becomes evident how the interplay of AI and innovation can pave the way for exciting new pathways.

Future Prospects for SailPoint Post-Acquisition

Potential IPO and Growth Strategies

The acquisition of SailPoint by Thoma Bravo marks a transformative chapter in the identity security company’s growth journey. With Thoma Bravo’s robust financial backing and strategic guidance, SailPoint is poised for significant expansion. A potential IPO could be on the horizon, as hinted by industry movements and market trends, allowing SailPoint to capitalize on its strengthened market position. The acquisition could also enable SailPoint to explore new growth strategies, including diversification of its product portfolio and expansion into untapped markets.

Projected revenue growth figures illustrate SailPoint’s potential, reflecting Thoma Bravo’s capability to drive substantial financial performance. The inclusion of advanced data-driven strategies could further enhance SailPoint’s position, creating new avenues for revenue streams.

Innovative Pathways with AI and Technology

Harnessing the power of artificial intelligence is key to SailPoint’s future, as AI technologies are expected to play a crucial role in developing competitive identity security solutions. By integrating AI, SailPoint is not only likely to improve its operational efficiency but also provide enhanced security features that are in high demand in today’s cybersecurity landscape.

Moreover, as Ignacio Villanueva emphasizes, the transformative potential of Generative AI can offer SailPoint “a sustainable competitive advantage” by revolutionizing industries (“Investment Services Industry Challenges & AI-Powered Solutions — D-LAB research”). Therefore, leveraging AI and technology effectively will cement SailPoint’s role as a leader in identity governance.

As we move forward, it is crucial to consider how these growth strategies and technological innovations will impact Thoma Bravo’s long-term vision for SailPoint and the broader identity security market.

Conclusion: The Bigger Picture

The acquisition of SailPoint by Thoma Bravo marks a significant turning point in the cybersecurity landscape, particularly in the domain of identity security. While the immediate focus may be on the transformation from a public to a private entity and the impacts on business dynamics, the long-term strategic implications cannot be overstated.

Thoma Bravo’s Long-term Vision for SailPoint

Under Thoma Bravo’s stewardship, SailPoint is positioned to become a leader in identity security with a robust foundation for sustainable growth. The private equity firm’s long-term vision involves not just financial revitalization but enhancing technological innovation within SailPoint. Thoma Bravo’s strategic leveraging of artificial intelligence and big data is expected to “drive operational efficiency and customer satisfaction,” which underscores their commitment to leveraging cutting-edge technology for value creation.

Implications for the Identity Security Market

The acquisition also has sweeping implications for the identity security market. Thoma Bravo’s focus on deploying AI solutions aligns with industry trends advocating for technological integration to “bring down management costs and remain competitive.” Such moves could lead to enhanced efficiency and reduced costs, benefits that may ripple through the cybersecurity landscape, thereby increasing competition and pushing innovation boundaries.

The visual representation of ‘SailPoint’s Buyer Universe’ provides insight into how the company stands in relation to its competitors and partners within the identity governance and administration (IGA) sectors. This strategic mapping shows how SailPoint can capitalize on its relationships and market position to spearhead advancements in identity security solutions.

As we look to the future, it becomes evident that Thoma Bravo and SailPoint are on a path to make remarkable contributions to the industry. The stage is set for innovations that could redefine identity security protocols. Moving forward, it will be interesting to explore how these strategic alignments shape recovery strategies and growth post-acquisition, particularly in light of emerging technologies and evolving market conditions.

Unlocking Growth in Industrial Technology through Private Equity

Industrial technology is transforming, pushing boundaries with innovations that were unimaginable just a few years ago. From advanced robotics to the Internet of Things (IoT), the sector is full of promise and potential. Yet, for startups and established companies alike, accessing the capital needed to innovate and expand can be a challenge. This is where private equity steps in, acting as a potent catalyst for growth in industrial technology. According to a report by PwC, private equity fund investment in industrial sectors has surged significantly, with approximately $93 billion invested globally in 2022 alone. This massive infusion of capital not only fuels growth but also drives competitive advantages, enhancing productivity and fostering innovation across the industry. It’s a dynamic landscape where private equity and industrial tech are reshaping the future, together. Curious about how this synergy is playing out and what it means for the future? Keep reading to uncover how private equity is unlocking unparalleled opportunities in industrial technology.

Understanding the Industrial Technology Landscape

The industrial technology landscape is marked by rapid advancements and dynamic shifts that continuously redefine what is possible within various sectors. As industries pursue efficiency and innovation, the landscape is characterized by a strong integration of digital solutions that bolster operational capabilities and market positioning.

Key Sectors Driving Innovation

Several key sectors are at the forefront of driving innovation within the industrial technology space. Manufacturing, aviation, and logistics are leading the transformation, with each investing heavily in technological advancements such as predictive maintenance, AI, and machine learning. These sectors are leveraging technology to enhance production processes, reduce downtime, and achieve unprecedented levels of efficiency. The adaptation of complex frameworks like IoT and robotics is particularly notable in manufacturing, making it a crucial sector propelling industrial innovation forward.

Emerging Trends and Technologies

Emerging trends predominantly revolve around the adoption of AI-driven solutions and the implementation of Industry 4.0 technologies. Predictive maintenance, a vital trend, is enhancing operational efficiency by reducing downtime and extending machinery lifespan. The increasing focus on sustainability is also notable, with companies integrating additive manufacturing and green tech to minimize environmental impact and optimize material usage.

In addition to these trends, automation and AI are significantly transforming supply chain management and customer engagement. Companies harness AI agents, customer sentiment analytics, and recommendation engines to streamline workflows and bolster customer loyalty, thereby driving revenue growth and operational efficiency. The emphasis on data security and IP protection adds a layer of complexity yet necessity in this rapidly evolving landscape. Recent insights suggest that robust data protection frameworks such as ISO 27002 and NIST contribute significantly to investor confidence by reducing investment risk (“ISO 27002 and NIST frameworks defend against value-eroding breaches, derisking investments” — D-LAB research).

As this landscape continues to evolve, private equity investors recognize the potential for growth and value creation. The integration of transformative technologies within industrial processes not only boosts productivity but also positions companies for long-term success. This necessitates a closer examination of how private equity can further catalyze these transformative changes, which we shall explore in the following sections.

The Role of Private Equity in Industrial Technology

Private equity plays a crucial role in the industrial technology sector by providing the much-needed capital, strategic guidance, and operational support to drive innovation and growth. The unique dynamics of industrial technology, characterized by high capital intensity and rapid technological advancements, make it an attractive yet challenging field for investment firms. As the sector evolves, private equity firms step in as catalysts for transformation, helping companies overcome capital constraints and scale their operations efficiently.

Why Private Equity Is Attracted to Industrial Tech

The attraction of private equity to industrial technology can be attributed to several factors. Firstly, the potential for significant returns is high due to the sector’s capacity for innovation and adaptation. Secondly, industrial technology often operates in industries with stable demand, offering a degree of risk mitigation. Private equity firms also see an opportunity to enhance value through strategic interventions, such as improving efficiency and integrating cutting-edge technologies.

Moreover, firms specialized in industrial technology often hold significant intellectual property, making them valuable assets. According to “Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research,” “Intellectual Property (IP) represents the innovative edge that differentiates a company from its competitors, and as such, it is one of the biggest factors contributing to a company’s valuation.” Investing in companies with robust IP portfolios allows private equity firms to leverage these assets for superior returns.

Case Studies: Successful Investments

Several case studies highlight the successful role of private equity in industrial technology. One approach involves integrating advanced technologies such as artificial intelligence and data analytics to optimize operations. Private equity firms have facilitated mergers and acquisitions that expand market reach and capabilities, driving both organic and inorganic growth.

For instance, in various portfolio companies, the incorporation of AI-driven insights has led to enhanced customer retention and increased revenue. As stated in the “Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research,” “AI and Generative AI analytics & success platforms increase LTV, reduce churn (-30%), and increase revenue (+20%).” Such strategic implementations result in significant uplift in valuation, making a compelling case for private equity interest.

These examples illustrate how private equity firms not only inject capital but also drive innovations that align with emerging trends, ultimately propelling industrial technology companies to new heights.

As we look towards the future, the role of technology in enhancing valuation cannot be understated. In the next section, we will delve into the ways technology can be leveraged to boost the valuation of industrial technology firms and ensure sustained growth.

Enhancing Valuation through Technology

In an industrial landscape ripe for transformation, technology stands out as a paramount driver of enhanced business valuation. Private equity firms have long recognized the power of technology to not only streamline operations but also to propel growth and increase the bottom line. By strategically leveraging advanced technologies, businesses can unlock new avenues for value creation and significantly enhance their attractiveness to potential buyers.

AI and Data Analytics for Better Outcomes

The deployment of AI and data analytics has ushered in a new era of operational efficiency and decision-making prowess. Firms that embrace these technologies gain a competitive edge by harnessing the power of data to drive insights and outcomes. AI’s predictive capabilities, when utilized effectively, can optimize sales strategies, enhance customer engagement, and improve product development processes.

Tools such as AI sales agents streamline sales cycles and improve close rates by intelligently analyzing customer data and behaviors. These agents not only automate mundane tasks but also “increase revenue by up to 50% and cut sales cycle times by 40%” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”). Moreover, AI-driven customer sentiment analytics provide personalized insights, which can boost market share and foster customer loyalty, leading to enhanced predictive analytics and a robust customer base.

IP and Data Protection: A Blueprint for Success

In today’s digital economy, protecting intellectual property (IP) and data is paramount. Private equity firms must ensure that their portfolio companies are equipped with stringent cybersecurity measures. This not only protects assets but also enhances enterprise value. By adhering to standards like ISO 27002, SOC 2, and the NIST framework, companies defend against breaches that can erode value and maintain compliance readiness to boost buyer confidence.

As technology continues to evolve, so do the opportunities to amplify company valuation through enhanced IP and data security. These protective measures are pivotal in “derisking investments and gaining buyer trust”, thereby ensuring that companies remain resilient and attractive in the eyes of investors (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

Equipped with these technological advancements, private equity firms can enhance the market readiness of their portfolio companies, preparing them for lucrative exits and sustained long-term growth. As we delve deeper, we’ll explore effective strategies that ensure portfolio companies are prepared for successful exit scenarios, further unlocking the potential for substantial valuation enhancement.

Strategies for Effective Portfolio Company Exits

Preparing Companies for Exit: Best Practices

To achieve successful exits, it is crucial for private equity players to meticulously prepare their portfolio companies. This involves enhancing the overall business model and strengthening financial performance. A well-prepared exit strategy focuses on streamlining operations, increasing efficiencies, and ensuring that the company is appealing to potential buyers. Establishing clear communication lines and ensuring transparency are key elements in cultivating buyer confidence and securing favorable deals.

Companies should pay attention to “protecting intellectual property and data,” as these are significant contributors to a company’s valuation. Strong IP strategies can result in higher valuation multiples, providing a competitive edge in the marketplace (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”).

Technologies that Enhance Exit Valuation

Incorporating advanced technologies into a company’s operations can dramatically improve its exit valuation. By leveraging artificial intelligence, predictive analytics, and other emerging technologies, companies can enhance efficiency, reduce costs, and ultimately boost revenue. “AI agents and analytics tools” because they can significantly increase closure rates, shorten sales cycles, and reduce customer acquisition costs (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”).

Additionally, using technologies like predictive maintenance and automated workflow solutions can enhance operational efficiency. For example, predictive maintenance strategies can reduce downtime by 50% and extend machine lifetimes, making manufacturing operations more attractive to potential buyers (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”).

Ensuring data and information security through compliance with frameworks such as ISO 27002, SOC 2, and NIST is vital. These frameworks can help protect a company from cyber threats, thereby preserving brand value and building trust with buyers (“Portfolio Company Exit Preparation Technologies to Enhance Valuation—D-LAB research”).

Incorporating technology not only optimizes current processes but also demonstrates to potential buyers that the company is forward-thinking and prepared for future technological trends.

Incorporating technology not only optimizes current processes but also demonstrates to potential buyers that the company is forward-thinking and prepared for future technological trends.

As companies look to the future, understanding and positioning for upcoming trends becomes essential in maintaining growth and ensuring successful exits. The following section will delve into the future opportunities in industrial technology and how to position effectively for these upcoming trends.

Future Opportunities in Industrial Technology Private Equity

The industrial technology space is poised for transformative growth over the next decade, offering unprecedented opportunities for private equity investors. Key drivers of this expansion include advancements in artificial intelligence (AI), automation, and digital transformation that are reshaping the industry and creating better prospects for companies involved.

Growth Drivers for the Next Decade

One of the primary drivers for future growth in industrial technology is the accelerated adoption of AI across manufacturing, logistics, and customer interaction processes. AI-driven tools such as predictive maintenance, smart supply chain management, and automated customer service systems provide significant efficiency gains. For example, “AI-led process optimization and additive manufacturing cut production defects by 40%, reduce retooling costs by 650%, and cut production costs by 60-70%,” thereby enhancing operational efficiency and profitability for portfolio companies (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

Furthermore, sustainability remains a critical factor, with companies focusing on reducing energy and material usage, enhancing their Environmental, Social, and Governance (ESG) profiles, which is increasingly important for investors. Another aspect is the progressive integration of the Internet of Things (IoT) into manufacturing processes through smart factories that operate with minimal human intervention.

How to Position for Upcoming Trends

To capitalize on these opportunities, private equity firms need to focus on enhancing the technological readiness of their portfolio companies by investing in cutting-edge digital tools and analytics. Integration of AI in workflow automation, for example, offers a high ROI for investors by “automating repetitive tasks,” which “\reduce costs and improve productivity” significantly (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

In addition, reinforcing data protection and IP security through frameworks such as ISO 27002, SOC 2, and NIST 2.0 is crucial. Such compliance boosts buyer confidence and protects value, evidenced by the fact that these frameworks provide a “competitive advantage through increased credibility and cost savings by optimizing processes” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

Entering the next decade, strategic alignment with these emerging technologies will not only enhance market reach but also improve valuation multiples, ultimately leading to successful exits for private equity firms. Transitioning from understanding current trends to implementing strategic initiatives will provide the groundwork for optimizing technology-driven enhancements, which we will explore further in the subsequent analysis of effective portfolio exit strategies.

Emerging Technologies: Value Creation for Sustainable Development

In today’s rapidly evolving world, the power of technology to drive sustainable development has become more critical than ever. Emerging technologies are not just buzzwords; they’re reshaping industries, economies, and societies in ways that promise to tackle some of the most pressing global challenges. From artificial intelligence to renewable energy solutions, these innovations offer new avenues for creating value while ensuring a more sustainable future. For instance, according to the International Energy Agency, renewable energy technologies alone could lead to a reduction of up to 70% of global carbon emissions by 2050, demonstrating their pivotal role in combating climate change. As we explore the intersection of technology and sustainability, this article will delve into how these technological advancements are transforming our world, fostering economic growth, and creating a better path forward for both people and the planet.

Understanding Emerging Technologies in the Context of Sustainability

Emerging technologies are pivotal in shaping the future of sustainability. They offer new ways to address pressing environmental, economic, and social challenges, enhancing our ability to build more resilient systems. Understanding these technologies involves recognizing their potential to revolutionize how we approach sustainability issues by leveraging innovation in key areas.

What Defines an Emerging Technology?

Emerging technologies are defined by their promise and potential to disrupt existing systems and processes. They tend to be in the early stages of development but have shown significant potential to create new markets or disrupt existing ones drastically. These technologies often build upon cutting-edge scientific research and are characterized by rapid progress and a high degree of integration with other technological advancements.

The Role of Innovation in Addressing Global Challenges

Innovation plays a critical role in tackling global challenges such as climate change, resource scarcity, and social inequality. By pushing the boundaries of what is possible, emerging technologies can offer innovative solutions that traditional approaches cannot. For instance, advancements in renewable energy technology not only provide cleaner alternatives to fossil fuels but also help to decrease dependencies on non-renewable resources.

Moreover, innovation in technology also facilitates better “information and decisions,” leading to “better outcomes” for sustainability efforts, which aligns with insights from D-LAB research on value creation through advanced technologies. Innovation is not just about creating technological marvels but also about maximizing their potential to promote sustainable practices.

As we deepen our understanding of how emerging technologies interact with sustainability, the next section will delve into specific technological advancements driving sustainable development.

Key Technologies Driving Sustainable Development

As the global community rallies to address environmental challenges, emerging technologies play a crucial role in driving sustainable development. These technologies not only promise to transform industries but also offer potential solutions to pressing global issues. Among them, Artificial Intelligence (AI) and Machine Learning, Renewable Energy Technologies, and Smart Cities and IoT Solutions are pivotal in this transformation.

Artificial Intelligence and Machine Learning

Artificial Intelligence and Machine Learning are at the forefront of technological advancements with numerous applications aiding sustainable development. AI-driven insights are enabling smarter decision-making across sectors, optimizing resources, and creating efficiencies that contribute to sustainability. These technologies are “enhancing workflow automation, improving customer retention, and optimizing manufacturing processes,” as they increase efficiency and reduce resource consumption, paving the way for a sustainable future (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

Renewable Energy Technologies

Renewable energy technologies like solar, wind, and hydroelectric power are foundational to reducing carbon emissions and mitigating climate change effects. Advances in these areas have substantially decreased the cost of renewable energy, making it a viable alternative to traditional fossil fuels. By investing in and deploying renewable energy technologies, countries can decrease their carbon footprints and address what Ignacio Villanueva describes as the transformative potential for “revolutionizing industries and providing businesses with a sustainable competitive advantage” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

Smart Cities and IoT Solutions

The concept of smart cities is becoming a reality through the integration of IoT solutions, which collect and analyze data to improve urban life quality. These solutions support efficient urban planning, enhance the management of resources like water and energy, and provide residents with a higher quality of life through well-coordinated public services. IoT plays a crucial role in achieving sustainability targets by enabling real-time monitoring and management of urban environments.

As we delve deeper into the impact of these technologies, the subsequent discussion will explore how technological advancements create further value by promoting economic growth, increasing resource efficiency, and fostering innovation in various sectors.

Value Creation Through Technological Advancements

Enhancing Economic Growth and Job Creation

Technological advancements have always been a catalyst for economic growth and job creation. By integrating cutting-edge technologies into existing business models, companies can increase efficiency, expand their reach, and ultimately boost their revenue. The automation of routine tasks and the enhancement of production processes, for instance, not only raise productivity but also allow businesses to allocate human resources to more strategic and creative roles.

Improving Resource Efficiency and Reducing Waste

Adopting innovative technologies improves resource efficiency and minimizes waste, contributing significantly to sustainable development. AI-driven systems can optimize supply chains, predictive analytics can forecast demand more accurately, and digital twins can enhance operational efficiencies. Such technological implementations are vital for reducing environmental footprints and improving economic outcomes.

Fostering Innovation and Competitiveness

The integration of emerging technologies into business models fosters a culture of innovation that propels companies ahead of their competitors. By continuously embracing and experimenting with new tools, businesses can unlock unprecedented levels of efficiency and creativity. This innovative edge is crucial for maintaining competitiveness in a rapidly evolving market.

Technological advancements not only bolster value creation but also lay the groundwork for leveraging AI strategically in sustainability, continuing to transform industries and enhance ecological responsibility.

Leveraging AI for Strategic Value in Sustainability

Artificial Intelligence (AI) has emerged as a game-changing technology in the quest for sustainable development, offering strategic value across various domains. By optimizing processes and enhancing decision-making capabilities, AI can significantly contribute to resource efficiency, climate resilience, and operational excellence.

Using AI to Optimize Energy Consumption

AI technologies play a pivotal role in optimizing energy consumption across industries, reducing both operational costs and environmental footprint. Smart grids and energy management systems driven by AI enable precise demand forecasting and load balancing, ensuring minimal energy wastage. These systems dynamically adjust energy usage, allowing for the integration of renewable energy sources and increasing their viability.

AI-driven analytics also empower industries to monitor their energy efficiency in real-time, identifying patterns and anomalies that help define optimization strategies. This results in substantial cost savings and a reduction in carbon emissions, facilitating the achievement of sustainability targets. In the long term, these efficiencies can lead to a “20% reduction in energy costs” and help enhance overall sustainability initiatives (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”).

AI in Climate Modeling and Impact Forecasting

Climate change poses one of the most significant challenges to sustainable development, and AI offers powerful tools to address this issue. By employing machine learning models, AI can analyze massive datasets to predict climate changes more accurately than traditional models. These models enhance our understanding of weather patterns, sea-level rise, and potential natural disasters, guiding strategic planning and risk management efforts.

Furthermore, AI applications in climate modeling can simulate various scenarios, providing insights into the potential impacts of both natural events and human activities. Policymakers and businesses can leverage these insights to make informed decisions on mitigating climate change effects and adapting infrastructure to withstand future challenges.

As we transition to the next section, we will delve into additional ways emerging technologies can enhance value creation, particularly focusing on their role in enhancing company valuations and increasing return on investment through intelligent data and insights.

Unique Insights: Portfolio Technologies for Value Enhancement

Preparing for Exits: Technologies Boosting Company Valuation

In the dynamic realm of emerging technologies, the potential for value creation is amplified when companies strategically deploy portfolio technologies that can enhance business valuation, particularly during exit preparations. Technologies that focus on improving operational efficiency, customer retention, and intelligent data utilization are at the forefront of this strategic shift. By incorporating advanced tools for predictive maintenance, companies can significantly decrease downtime and increase production efficiency by up to 30%, thereby improving EBITDA margins and increasing the attractiveness to potential acquirers.

Furthermore, protecting intellectual property and customer data is crucial for safeguarding company value. “ISO 27002, SOC 2, and NIST frameworks defend against value-eroding breaches, derisking investments; compliance readiness boosts buyer trust.” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”) This not only ensures regulatory compliance but also increases trust and credibility among investors.

Increasing ROI with Intelligent Data and Insights

The ability to harness data for actionable insights is revolutionizing how companies realize value from their existing assets. By leveraging AI-driven analytical tools, businesses can increase customer retention and amplify engagement through personalized experiences. For instance, GenAI analytics and success platforms have been shown to considerably reduce customer churn by up to 30%, while simultaneously boosting revenue by 20%. Such technologies provide a dual benefit: enhancing customer lifetime value and reducing acquisition costs, which cumulatively “enhances the EV/Revenue and EV/EBITDA multiples, thus boosting investor confidence.”

Moreover, dynamic pricing software and AI-powered recommendation engines provide tailored, data-backed suggestions that enhance deal size and conversion rates. With a possible “30% increase in average order value” and up to “10-15% revenue increase through improved upselling, cross-selling, and customer loyalty,” these technologies are indispensable to companies looking to maximize financial performance and market presence.

These insights illustrate the tremendous impact of selecting the appropriate technologies to create significant value enhancements within a portfolio. As we look ahead to the future of sustainable technological integration, it’s essential to navigate the challenges that lie ahead and craft strategies that balance ethical considerations with innovative advancement, shepherding the path to collective progress.

The Road Ahead: Challenges and Strategies for Sustainable Tech Integration

Integrating emerging technologies into sustainable development requires navigating a myriad of challenges and employing strategic approaches to ensure successful outcomes. As we move forward, businesses and governments need to address several key obstacles to effectively leverage technology for sustainability.

Balancing Innovation with Ethical Considerations

One of the primary challenges is ensuring that technological innovation aligns with ethical considerations. This involves addressing concerns related to privacy, security, and the societal impact of new technologies. The development and deployment of these technologies must be guided by ethical guidelines to avoid potential misuse and to promote positive societal outcomes. Establishing clear ethical frameworks and standards will be essential to balance the pursuit of innovation with the need for responsible tech integration.

Navigating Regulatory and Compliance Hurdles

Another significant challenge is the complex web of regulatory and compliance requirements that can vary significantly across regions and industries. Regulatory frameworks need to adapt quickly to keep pace with technological advancements while protecting consumers and ensuring fair competition. Companies must remain vigilant and proactive in understanding and complying with existing and emerging regulations. As noted, frameworks such as ISO 27002 and SOC 2 play a critical role by “defending against value-eroding breaches, derisking investments; compliance readiness boosts buyer trust” (“Portfolio Company Exit Preparation Technologies to Enhance Valuation — D-LAB research”). This not only helps in ensuring compliance but also in building trust among investors and consumers.

Building Partnerships for Collective Progress

Collaboration is fundamental in overcoming the hurdles of sustainable tech integration. Building strong partnerships between private, public, and academic sectors can foster innovation and facilitate the sharing of knowledge and resources. These collaborations can help address complex challenges and accelerate the deployment of technologies. Companies may also find value in collaborating with innovators and startups to stay ahead of the curve and gain insights into cutting-edge solutions.

As we explore the future of sustainable development through technology, it’s crucial to recognize the potential transformations that lie ahead. This understanding will set the stage for the next section, where we delve into the unique insights and strategies that pivotal technologies offer for enhancing value in this vibrant landscape.

Technology Value Creation: Harnessing AI for a Competitive Edge