Private equity firms are under pressure to move faster and with more certainty. It’s no longer enough to back good companies and wait for market tailwinds — value creation now comes from surgical improvements across revenue, operations, technology and risk, often delivered in months rather than years. That’s where private equity consulting services fit in: they bring outside capability, playbooks and hands‑on delivery to turn strategic ideas into measurable gains.

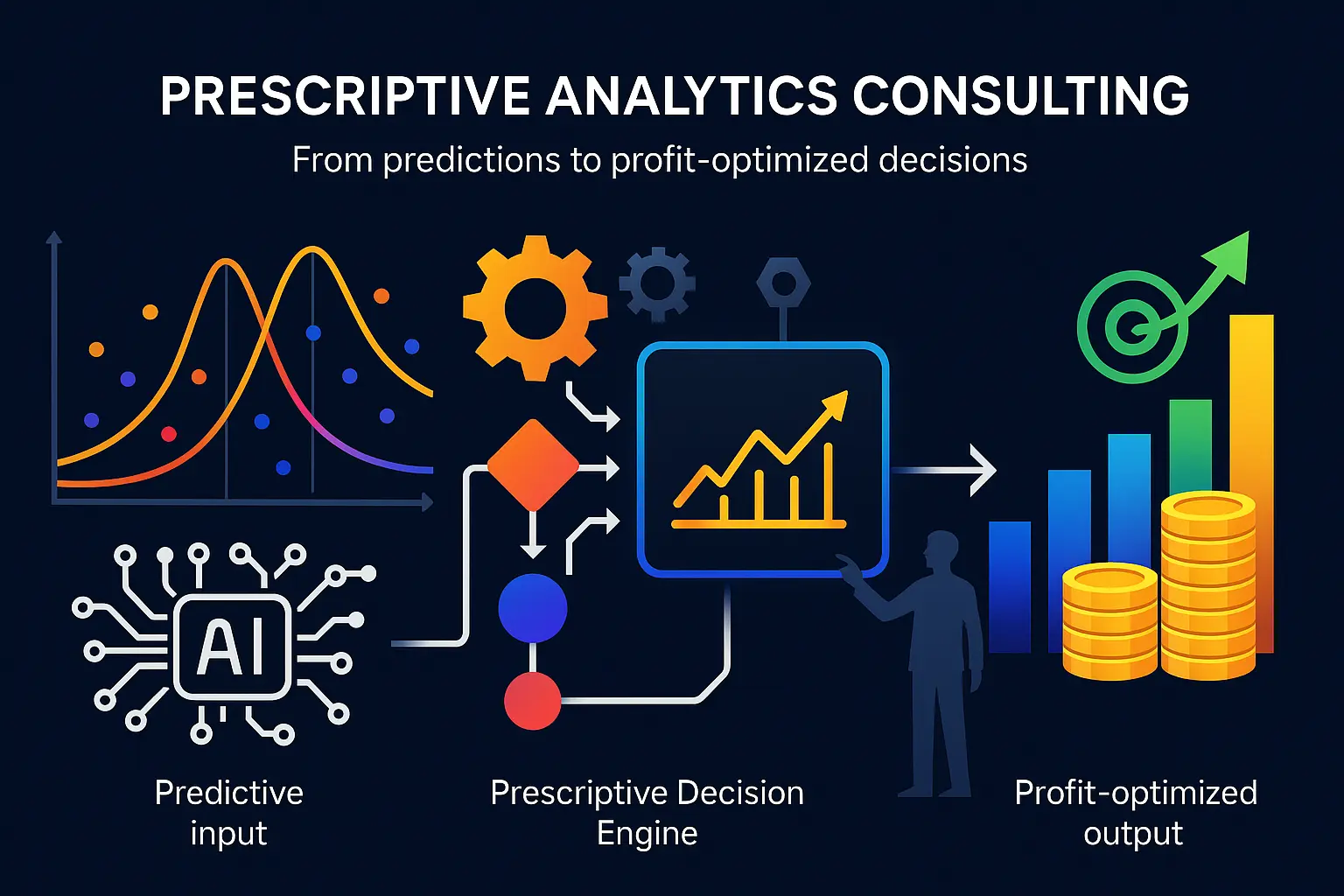

Two accelerators make the biggest difference today: practical AI (applied to sales, pricing, retention and operations) and deep sector fluency (so fixes are realistic and repeatable). When these come together you get not just recommendations but faster implementation, clearer KPIs and a stronger exit story — from deal origination through first 100 days to exit readiness.

This article walks through the full deal cycle and the specific levers PE teams care about: data‑driven sourcing, commercial and tech due diligence that quantifies upside and risk, quick 90‑day value sprints, and how to pick a partner who can both design strategy and run the work. Expect concrete examples for revenue engines, retention and NRR, cost and efficiency, and sector playbooks — including a life sciences lens where regulatory, R&D and supply‑chain moves are especially material.

If you want, I can pull in recent, sourced statistics and cite them directly in this intro — say which claim you’d like quantified and I’ll fetch the data and add links.

What private equity consulting services cover across the deal cycle

Deal origination and thesis building powered by data and market signals

Consulting teams help funds turn broad sector theses into a targeted pipeline by layering proprietary research, third‑party market signals and buyer‑intent platforms. Workstreams include segmentation and TAM refinement, automated deal-scouting (news, web, event signals), intent-data integration and prioritization algorithms to spot high-propensity targets and off‑market opportunities faster than traditional outreach.

Where available, buyer‑intent signals are woven into outreach and qualification playbooks so that sourcing converts into meetings and offers more efficiently. As one documented outcome from buyer‑intent platforms shows, these tools can materially shift pipeline performance: “32% increase in close rates (Alexandre Depres).” Fundraising Preparation Technologies to Enhance Pre‑Deal Valuation — D‑LAB research

Consultants also translate thesis into diligence checklists and scoring rubrics so origination funnels produce targets that match hold‑period value creation plans rather than just headline growth metrics.

Commercial, tech, and operational due diligence that quantifies upside and risk

Due diligence spans three integrated tracks: commercial (market, customers, go‑to‑market efficiency), technical (architecture, product roadmap, engineering velocity) and operational (cost base, supply chain, manufacturing). Consulting teams deliver rapid diagnostic sprints that quantify revenue levers, margin improvement opportunities and implementation effort, producing a prioritized value map and sensitivity analyses for bid negotiations.

Typical deliverables: KPI baselines and forward scenarios, tech‑risk heatmaps (scalability, technical debt, IP exposure), vendor and contracts review, and an action‑oriented closing checklist that aligns legal, IT and commercial closing conditions to the fund’s value plan.

First 100 days: value creation office, roadmap, and resourcing

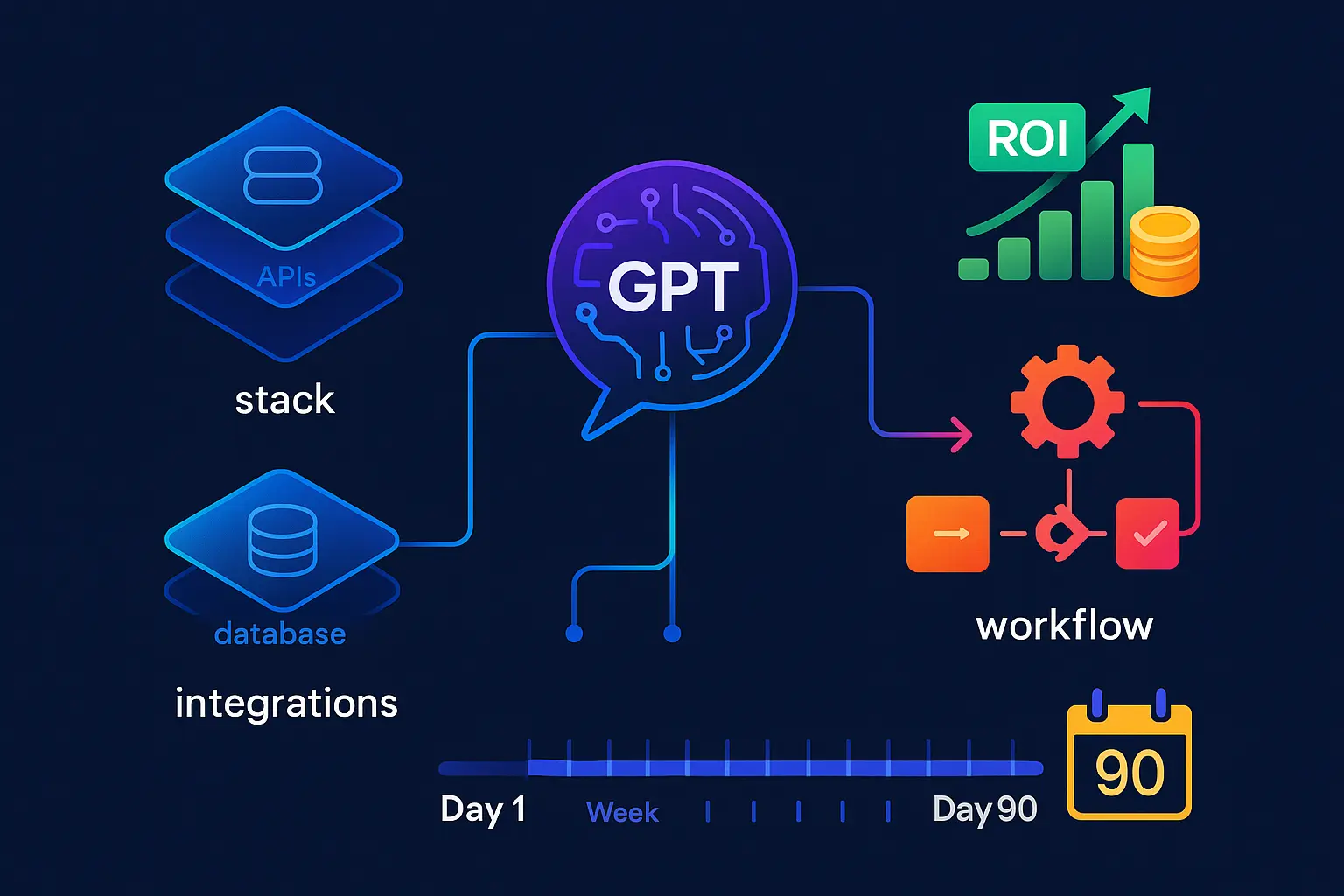

Post-close the emphasis shifts to fast, measurable impact. Consultants stand up a value creation office (VCO), codify the 90–180 day roadmap, assign owners and embed an operating cadence (weekly reviews, dashboards, OKRs). Typical early initiatives focus on quick wins that de‑risk the plan and unlock cash: sales process automation, pricing tests, customer success playbooks, supply‑chain triage and targeted cost takeouts.

Services combine strategy and hands‑on build-and-run: implementing AI sales agents and buyer‑intent workflows, deploying customer health platforms to arrest churn, and running pilot predictive‑maintenance or inventory optimization projects where relevant. The goal is to convert diligence hypotheses into proven, tracked KPI deltas within the first months of ownership.

Exit readiness: KPI proof, story shaping, and buyer diligence rehearsal

Preparing a company for sale requires both the evidence and the narrative. Consultants consolidate validated KPIs, create a clear growth story tied to implemented initiatives, and run buyer‑facing rehearsals and data rooms to surface and remediate the issues acquirers will test. That includes packaging recurring revenue performance, technology roadmaps, product moats and commercial playbooks so buyers can underwrite future cash flows with confidence.

Protecting the assets that underpin the story is core to readiness. As one analysis notes, “Intellectual Property (IP) represents the innovative edge that differentiates a company from its competitors, and as such, it is one of the biggest factors contributing to a companys valuation.” Fundraising Preparation Technologies to Enhance Pre‑Deal Valuation — D‑LAB research

To that end, consulting engagements typically include an IP and data protection audit, remediation plan to meet SOC 2/ISO/NIST expectations, and a buyer‑diligence rehearsal that tests the narrative end‑to‑end so exits close faster and at higher multiples.

Having mapped services across origination, diligence, value‑capture and exit preparations, the next step is to translate those interventions into the concrete value levers and KPIs that investors will track throughout ownership.

Value levers PE teams expect now—and the metrics that matter

Revenue engines: AI sales agents, dynamic pricing, and recommendations

Private equity value creation now often targets top‑line acceleration through modern commercial engines: AI‑driven sales agents that score and outreach to high‑propensity leads, dynamic pricing that captures demand and segment value, and recommendation systems that increase basket size and cross‑sell. Consultants prioritize interventions that lift conversion and deal size while lowering acquisition cost.

Key metrics to track: annual recurring revenue (ARR) or revenue run rate, new bookings, average deal size, win rate, pipeline coverage, sales cycle length, conversion rate by stage, customer acquisition cost (CAC) and CAC payback period, and uplift in upsell/repeat revenue.

Retention and NRR: customer sentiment analytics and CX assistants

Retention is a compounder of value: small improvements in renewal and expansion behavior materially raise enterprise value. PE teams deploy customer sentiment analytics, product usage signals and CX assistants to detect at‑risk accounts, automate targeted interventions and unlock expansion opportunities.

Key metrics to track: net revenue retention (NRR) or equivalent renewal/expansion ratios, gross and net churn (by revenue and by customer count), renewal rate, expansion MRR/ARR, cohort retention curves, customer lifetime value (LTV), NPS/CSAT trends and product engagement metrics (active users, feature adoption).

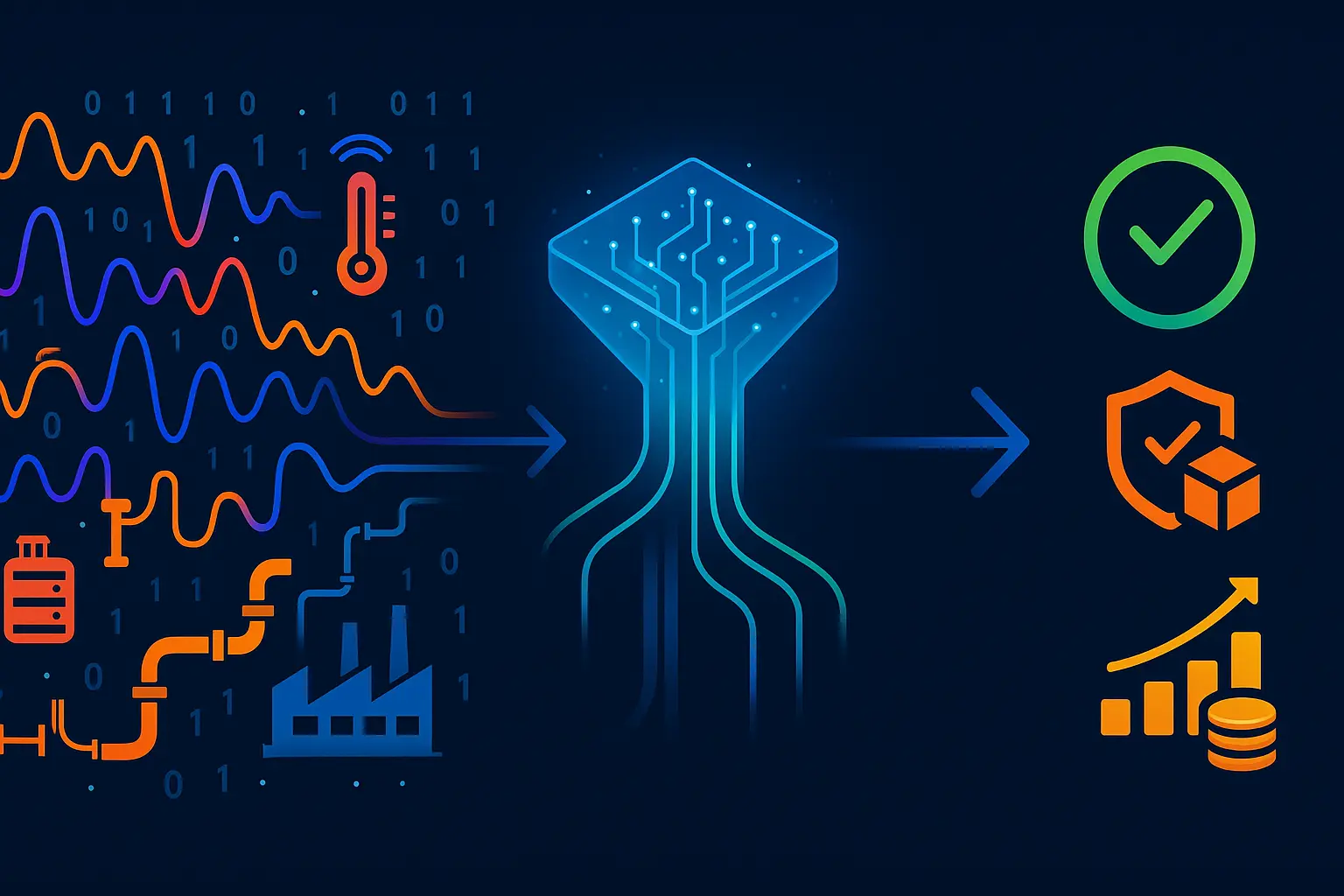

Cost and efficiency: workflow automation, predictive maintenance, supply chain optimization

Cost levers remain central to margin improvement. Typical plays include automating repetitive processes, introducing AI co‑pilots to boost employee productivity, predictive maintenance to reduce downtime, and supply‑chain optimization to lower working capital and loss from disruption. These changes both reduce cash burn and free management capacity for growth initiatives.

Key metrics to track: EBITDA and EBITDA margin, operating expense ratio (OPEX as % of revenue), cost per unit or per customer, headcount productivity (revenue or profit per FTE), uptime/availability, mean time to repair (MTTR), mean time between failures (MTBF), inventory turns, days sales outstanding (DSO) and working capital days.

Risk reduction: IP and data protection via ISO 27002, SOC 2, and NIST

Risk mitigation preserves value by making a business investible and defensible. Strengthening IP management, tightening data governance and aligning to security frameworks reduces buyer friction, lowers potential liabilities and protects revenue streams. Practical workstreams include IP audits, patching technical debt, access controls, logging and incident response playbooks.

Key metrics to track: results of control assessments (audit findings closed), time to remediate critical vulnerabilities, percentage of systems with up‑to‑date backups and tested restores, data breach incidents (count and severity), contractual security requirements met (e.g., attestations or certifications), and any cyber insurance exposures or claim trends.

Across all levers, PE teams expect consulting partners to deliver clear before/after baselines, realistic lift estimates and an agreed set of KPIs with owners and reporting cadence. With those in place, the same playbooks can be adapted to sector‑specific needs where regulatory, R&D or operational timelines change how quickly each lever converts into exit value.

Life sciences playbook for PE value creation

Investment shifts: weight‑loss drugs vs. gene therapy—where capital is flowing

Assessing thematic exposure is the first step: PE teams should map portfolio companies against prevailing scientific, commercial and payer landscapes to understand which assets need scale, which need de‑risking and which should be harvested or spun out. That assessment drives capital allocation, time‑to‑exit expectations and the mix of near‑term commercial plays versus long‑duration scientific bets.

Practical actions consultants lead include market and payer landscaping, competitive and unmet‑need analysis, and building investment scorecards that weight scientific maturity, regulatory pathway clarity, commercial potential and exitability. These tools help funds prioritise where to deploy growth capital and where to focus operational improvements.

R&D productivity: virtual research assistants and molecular AI for faster hit rates

Improving R&D productivity is both a scientific and an operational challenge. PE value creation in life sciences focuses on shortening decision loops in discovery and early development, improving data quality and accelerating translational milestones that unlock value.

Typical interventions include implementing data‑centric platforms for literature and trial data synthesis, deploying automated workflows to reduce manual curation, instituting go/no‑go gates with clear success criteria, and partnering with specialist vendors (CROs, AI platforms) to run targeted pilots. Consultants also help establish metrics and governance—so R&D effort translates into predictable milestone delivery that can be communicated to investors and buyers.

Supply chain resilience: planning tools to cut disruptions and inventory waste

Life sciences supply chains are often complex and regulated; resilience reduces both cost and commercial risk. Consulting teams focus on visibility, redundancy and optimized inventory strategies that reflect product shelf life and clinical/commercial demand volatility.

Typical workstreams include demand forecasting and scenario planning, supplier risk scoring and dual‑sourcing strategies, cold‑chain assurance for biologics, serialization and traceability implementation, and inventory optimisation to free working capital while meeting patient needs. These measures reduce interruption risk and strengthen the operational story for future acquirers.

Regulatory pressures: building compliance and documentation into operations

Regulatory readiness is a core value preserver in life sciences. PE sponsors benefit when compliance is treated as a built‑in feature of operations rather than a post‑hoc cost. That means codifying quality systems, standardising documentation and ensuring inspection readiness across development and manufacturing.

Consultants typically establish a regulatory roadmap aligned to the target product profile and exit timeline, implement quality management and electronic trial master file systems, and run mock inspections and gap closures. The result is reduced regulatory uncertainty, cleaner due diligence and a stronger narrative at exit.

Combined, these playbook elements create a life sciences value agenda that balances scientific upside, commercial acceleration and operational resilience. The next step is to convert this agenda into a time‑bound engagement with measurable KPIs and prioritized pilots that prove the thesis quickly and visibly.

Thank you for reading Diligize’s blog!

Are you looking for strategic advise?

Subscribe to our newsletter!

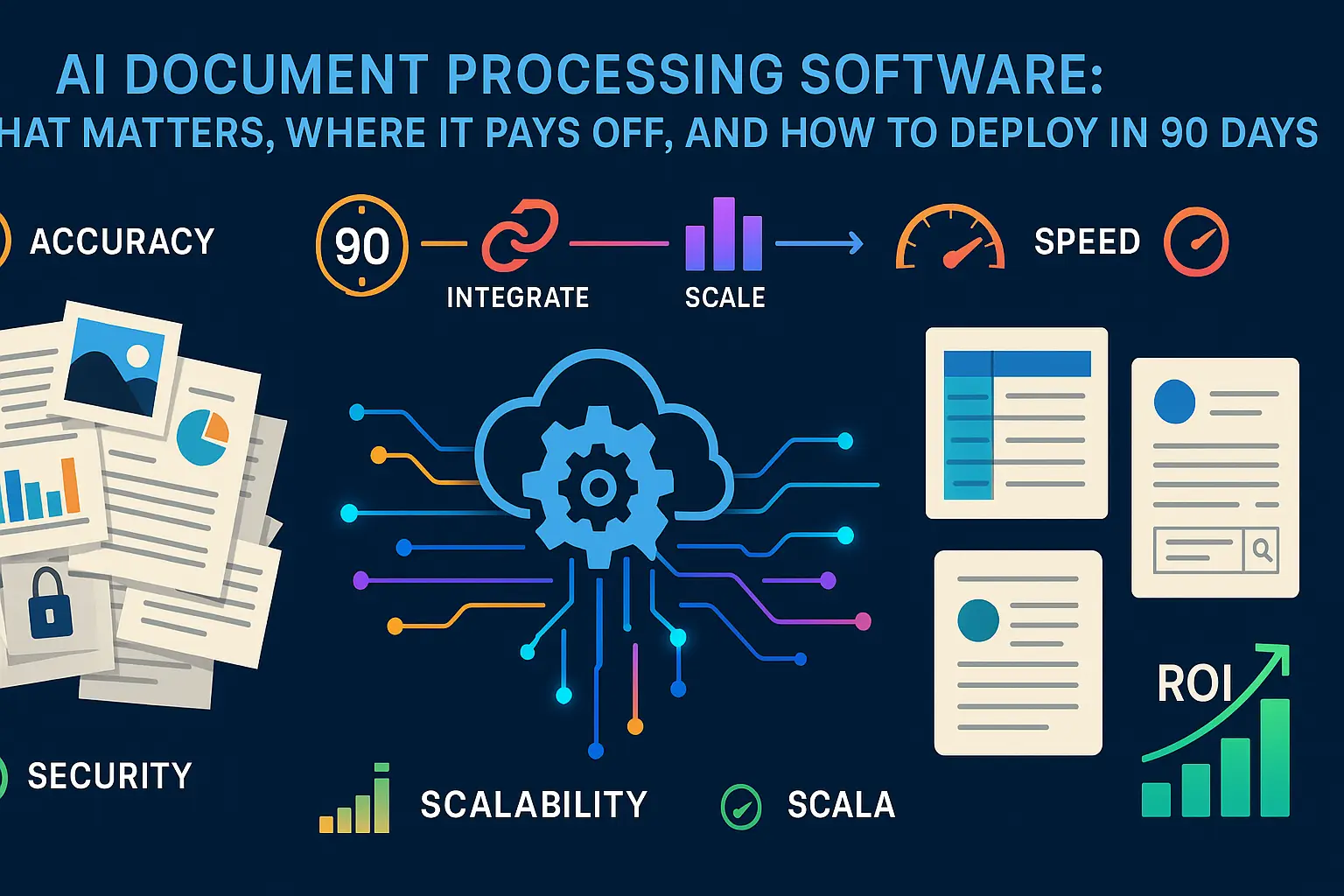

A 90‑day engagement plan and the KPIs to track

Diagnostic sprints: baseline churn, CAC payback, NRR, uptime, and defect rates

Week 0–2 focuses on rapid diagnostics: assemble data sources, validate measurement definitions, and produce KPI baselines. Deliverables include a data inventory, a prioritized KPI list with owners, and a short heatmap of opportunity areas (commercial, retention, operations, security).

Primary KPIs to baseline and monitor during diagnostics: net revenue retention (NRR), gross and net churn, CAC and CAC payback period, conversion rates by funnel stage, sales‑cycle length, uptime/availability, mean time to repair (MTTR), defect or failure rate, inventory days and supply‑chain cost as a % of revenue, and core margin/EBITDA metrics.

Quick wins: rapid pilots designed to prove value

Weeks 3–6 run 2–4 tightly scoped pilots that are small to implement but high impact — examples include an AI sales‑agent pilot on a high‑value segment, a dynamic pricing test, a churn‑prevention play using customer health scores, or an inventory re‑balancing pilot for fast‑moving SKUs. Each pilot must have a clear hypothesis, success threshold and control group where feasible.

Set explicit targets for pilots and measure with the same rigor used in diligence: uplift vs. baseline, statistical significance where relevant, and cost to implement. As a benchmark for expected outcomes, “Targeted 90-day value sprints commonly deliver observable quick wins: >10% NRR lifts, ~40% reductions in sales-cycle time, and up to ~25% cuts in supply‑chain costs when AI and process fixes are applied to the right levers.” Portfolio Company Exit Preparation Technologies to Enhance Valuation — D‑LAB research

Operating cadence: weekly value office, dashboards, and OKRs

Weeks 7–12 shift from pilots to scaling and embedding: stand up a weekly value office (VCO) meeting, publish a single source-of-truth dashboard, and operationalize OKRs tied to the prioritized KPIs. The VCO enforces decision gates — kill, iterate or scale — and resolves resource bottlenecks.

Measurement discipline is essential: require before/after snapshots, owner‑signed results, and an audit trail of configuration or process changes. Use short feedback loops (weekly) for tactical fixes and monthly deep reviews for strategic adjustments. Include runbooks that map data flows, measurement logic and escalation paths so gains survive leadership or team changes.

Exit narrative: tech moat, ESG outcomes, and resilience proof points

By day 90 the goal is not just operational improvement but verifiable evidence: repeatable KPI deltas, case studies from pilots, tightened security/IP posture, and documented governance. Package these into the exit narrative: a quantified story that links actions to valuation drivers (recurring revenue, margin expansion, lower working capital, lower regulatory risk).

Typical deliverables at the end of 90 days: KPI baseline vs. current, validated pilot results, a 6–12 month scale plan with cost/benefit and resource estimates, risk register with remediation timelines, and an investor‑ready one‑pager that summarizes proven deltas and remaining opportunities.

When a fund has these 90‑day proofs and documented KPI deltas, it becomes straightforward to decide which initiatives to scale, which capabilities to retain in‑house and which require external partners or specialist vendors — and to do so with a clear measurement and governance model that preserves the value created.

How to choose a partner for private equity consulting services

Choosing the right consulting partner determines how quickly value is realised and how durable improvements are at exit. Prioritise vendors who can demonstrate measurable outcomes, run the work end‑to‑end, protect the company’s critical assets, and bring deep, relevant sector experience.

Measured impact over marketing—ask for audited before/after KPI deltas

Demand evidence, not buzzwords. The best partners bring audited before/after KPI deltas, transparent measurement logic and client references that corroborate claims. Clarify baseline definitions, measurement windows and attribution assumptions up front so any claimed lift is verifiable.

Build-and-run capability—strategy plus hands‑on implementation and tooling

Strategy without delivery stalls. Prefer partners who combine advisory with implementation teams, tooling or product components, and a clear handover plan so improvements persist after the engagement ends.

Security‑by‑design—IP and data protection baked into every workstream

Security and IP protection are table stakes. The partner should treat data governance, access controls and IP mapping as core deliverables rather than optional add‑ons, and be able to integrate with the portfolio company’s legal and IT teams.

Sector fluency—references in your industry, stage, and deal type

Domain knowledge shortens learning curves and improves judgement. Look for partners with hands‑on experience in your target sectors and deal stages, plus named SMEs who will lead the engagement rather than generalists parachuting in.

Finally, formalise selection with a short, paid diagnostic or pilot using a simple scorecard across impact, delivery capability, security posture and sector fit; that pilot becomes the real test of chemistry, speed and measurable return before committing to a larger engagement.