In the digital age, protecting personal information has become more crucial than ever. With the California Consumer Privacy Act (CCPA), businesses operating in California—or handling data of California residents—are required to comply with strict data privacy regulations. Navigating these complex regulations can be daunting, but innovative software solutions have emerged to simplify compliance processes. Did you know that according to a CCPA Compliance Survey by TrustArc in 2021, 88% of businesses found it challenging to manage data privacy requirements? This highlights the pressing need for efficient tools that can help businesses not only meet compliance requirements but also safeguard consumer trust. Dive into this guide to explore how leveraging the right technology is key to mastering CCPA compliance.

“`Understanding CCPA: A Quick Refresher

What is CCPA?

The California Consumer Privacy Act (CCPA), enacted in 2018, is a landmark privacy regulation that seeks to enhance consumer protection and privacy rights for residents of California. It applies to any business that collects personal data from California residents, and its reach extends beyond the state’s borders, impacting businesses nationwide. The CCPA grants consumers significant control over their personal information by imposing strict guidelines on how businesses can collect, manage, and share data.

Key Consumer Rights Under CCPA

The CCPA empowers consumers with several essential rights to ensure their data privacy. These include the right to know what personal data is being collected, the right to delete personal data held by businesses, the right to opt-out of the sale of their personal data, and the right to non-discrimination if they choose to exercise these rights. Additionally, businesses are required to provide detailed information about data collection practices in their privacy policies, creating a transparent data ecosystem.

As we proceed, you’ll discover how leveraging innovative software solutions can significantly streamline the journey towards compliance, ensuring your business navigates the complex requirements with ease.

How CCPA Compliance Software Streamlines Your Process

The Role of AI in Compliance

CCPA compliance software has transformed traditional approaches by integrating artificial intelligence to simplify and optimize regulatory adherence. AI enhances the process by automating data collection, categorization, and documentation, significantly decreasing the time required for compliance tasks. This technology ensures accuracy and precision, reducing human error and enabling businesses to focus on strategic initiatives rather than manual compliance tasks.

Advanced AI solutions can monitor regulatory changes actively, ensuring that companies remain compliant without constant manual oversight. As regulations evolve, AI-powered platforms automatically update compliance protocols, keeping businesses agile and proactive.

Tailored Solutions for the Insurance Industry

The insurance industry faces unique compliance challenges, including managing vast amounts of sensitive customer data and adhering to evolving regulatory standards. CCPA compliance software specifically tailored for this sector can address these issues effectively. “AI automates regulatory monitoring, document creation, data collection and organization for regulatory filings, filing automation, compliance checks, risk analysis, and audit reporting and support,” offering insurance companies a robust framework to navigate complex regulations (“Insurance Industry Challenges & AI-Powered Solutions — D-LAB research”).

This tailored approach ensures that insurance firms can leverage AI-driven automation to reduce compliance workload significantly while enhancing data protection and privacy standards. By doing so, these solutions not only streamline regulatory processes but also improve operational efficiency overall.

As we venture further into the nuances of CCPA compliance, our next step is understanding how to choose the right software that aligns with specific organizational needs and objectives.

Selecting the Right CCPA Compliance Software

Evaluating Features and Functionality

When selecting CCPA compliance software, evaluating its features and functionality is crucial to ensure that it meets your organization’s specific needs. Key functionalities to consider include data mapping capabilities, consumer request management, and automated reporting for audits. It’s also essential that the software can handle the dynamic nature of compliance requirements, effectively adapting to changes as they occur.

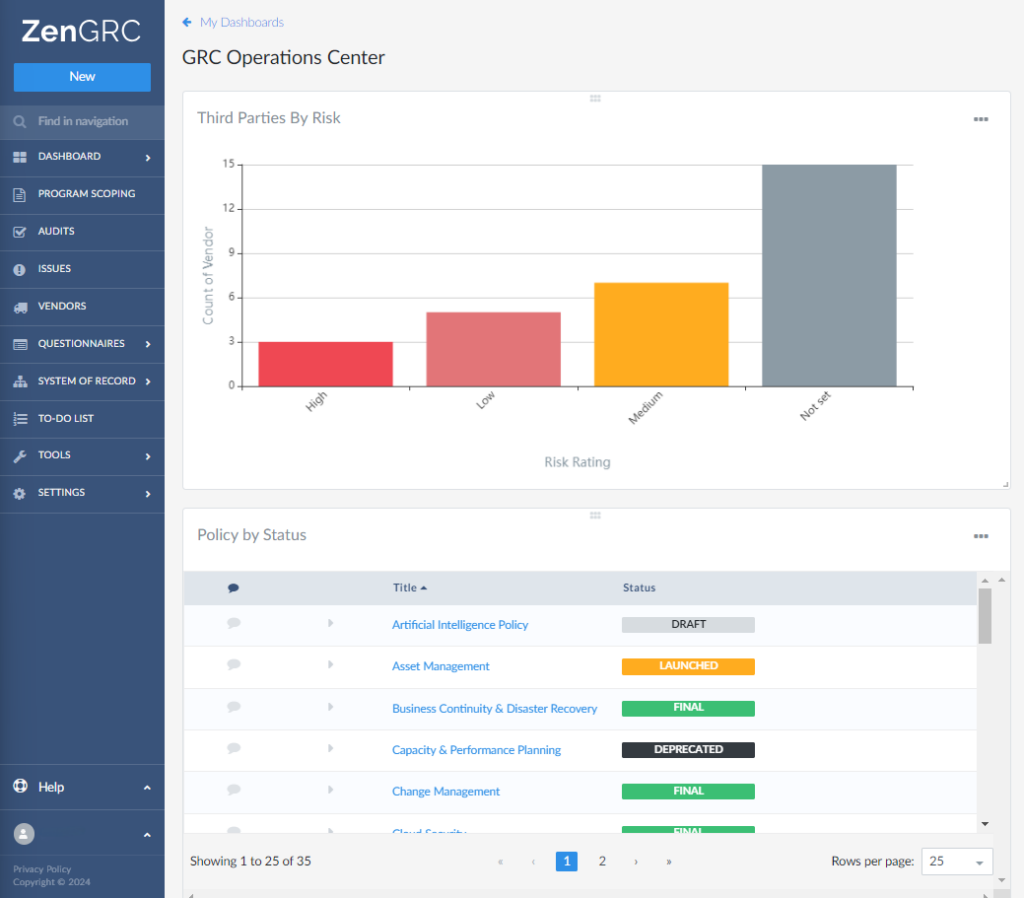

Visualizing data effectively is a significant advantage; thus, look for software that provides comprehensive dashboards that make compliance oversight intuitive and straightforward. Such dashboards offer insights into third-party risk management and monitor policies’ statuses effectively.

Considering Vendor Reputation

The reputation of the software vendor is another critical factor. Researching vendor history in data compliance, client testimonials, and industry recognition helps ensure reliability and trustworthiness. A vendor with a solid track record will likely provide consistent support and updates essential for staying ahead of regulatory changes.

Moreover, consider how the vendor is preparing for the future. As “compliance changes” present ongoing challenges, selecting a vendor committed to future-proofing their solutions against emerging regulations is paramount. “Failing to adhere to regulations can expose firms to hefty fines, legal action and an unwanted reputation” (“Insurance Industry Challenges & AI-Powered Solutions” — D-LAB research). Therefore, a vendor dedicated to innovation and compliance adaptability is a strategic choice.

Having considered these aspects, it’s time to explore how you can ensure your compliance strategy remains adaptive and resilient amid evolving regulatory landscapes.

Thank you for reading Diligize’s blog!

Are you looking for strategic advise?

Subscribe to our newsletter!

CCPA and Beyond: Future-Proof Your Compliance Strategy

Adapting to Regulatory Changes

As privacy regulations like the CCPA evolve and more states introduce similar laws, businesses must remain vigilant and adaptable. The landscape is rapidly changing, and failing to adhere to these regulations can have serious repercussions, including hefty fines and legal challenges. To effectively navigate this complex environment, companies need robust systems that can adapt to new regulations with agility.

A key strategy for staying ahead is implementing AI-driven solutions that offer regulatory monitoring and compliance management. These tools help businesses stay proactive by automating the tracking of legal updates across various jurisdictions, significantly reducing the efforts required for manual monitoring. The efficiency gained from such tools cannot be understated, with one study noting that AI-driven compliance tools can process regulatory updates “15-30x faster” than traditional methods, while reducing documentation errors by as much as “89%” (“Insurance Industry Challenges & AI-Powered Solutions — D-LAB research”).

Leveraging AI for Continuous Improvement

AI technology offers continuous optimization avenues for businesses aiming to enhance their compliance strategies further. By leveraging AI, companies can not only monitor regulatory changes more effectively but also improve operational efficiency and reduce transactional risks. AI tools can analyze vast amounts of data to identify risks, streamline compliance checks, and provide insightful reports that highlight areas needing attention.

Furthermore, AI technologies support better resource management by automating repetitive tasks, enabling staff to focus on more strategic initiatives that enhance the company’s competitive position. As businesses look towards a future where regulatory landscapes are in constant flux, harnessing the capabilities of AI becomes essential. Implementing solutions like AI ensures that operational frameworks remain robust against new challenges, thus maintaining compliance and safeguarding livelihoods. This allows businesses to remain nimble, adapt to changes with minimal disruption, and continuously optimize for improved service delivery and customer satisfaction.

Moving forward, understanding these advanced implementations will be crucial as we delve into specific industry challenges and AI-powered solutions to those obstacles.

Insurance Industry Insights: Challenges and AI-Powered Solutions

Addressing Talent Shortages Through Automation

The insurance industry is facing a significant challenge with an impending talent shortage, as it’s projected that by 2036, 50% of the current workforce will retire, leaving more than 400,000 positions unfilled. This shortage necessitates doing more with fewer employees, a challenge that AI-powered solutions are well-equipped to address. AI can be leveraged to increase the productivity of existing staff by automating routine tasks, thus allowing the workforce to focus on higher-value activities. For example, “AI increases underwriters’ productivity by summarizing reports and policies, streamlining product design, optimizing prices, providing competitive intelligence, and generating reports and fraud rules” — Insurance Industry Challenges & AI-Powered Solutions. Such automation enables a “50%+ increase in underwriters’ productivity,” which is crucial for maintaining service levels in the face of reducing human resources.

Enhancing Claims Processing Efficiency

Efficient claims processing is paramount for customer satisfaction in the insurance industry. However, the current state of claims handling often results in delays and additional costs. AI can revolutionize this area by automating various stages of claims processing—from the submission and evaluation of claims to fraud detection and client communication. AI technologies not only quicken the process, reducing timeframes by “40-50%,” but also reduce the incidence of fraudulent claims, safeguarding the insurer’s financial interests. These innovations “help insurers to improve customer experience by providing quicker and more transparent service,” thereby reducing churn and increasing loyalty.

With talent shortages and inefficiencies being critical challenges for the insurance sector, the adoption of AI-powered solutions presents a feasible pathway forward. As insurers contemplate these strategic adoptions, the next logical step is to explore the landscape of CCPA compliance software that can streamline these and other industry processes efficiently.