Value-add expertise across the investment cycle.

Services

Technology Due Diligence

Services

Technology due diligence

What is technology due diligence?

Technology due diligence

Technology due diligence is an assessment process used by private equity firms to evaluate the technological aspects of a target company before making an investment. It involves analysing the target company's technology infrastructure, systems, intellectual property, and IT capabilities to understand its strengths, weaknesses, and potential risks. The goal is to ensure that the technology aligns with the investment thesis, identify any issues or opportunities, and make informed investment decisions based on the technology-related factors.

What does a due diligence scope need to include?

Technology due diligence

A typical Diligize technology due diligence high-level scope might include, but is not limited to, the review and assessment of the following areas:

Software and Hardware Assets

This includes an inventory of all proprietary software and hardware, examining their condition, relevance, and how they contribute to business operations.

Intellectual Property

A company's patents, trade secrets, copyrights, trademarks, and other intellectual property (IP) rights can be valuable assets. It's important to know whether the company owns these rights outright or if they're shared or licensed from another entity.

Infrastructure

This refers to the company's technical infrastructure, like servers, network systems, and databases. It's crucial to understand how robust, scalable, and secure this infrastructure is.

Cyber and Information Security

It's crucial to evaluate the company's cybersecurity measures, vulnerabilities, past breaches, and overall data protection policies.

Software Development Practices

These include practices like software development, quality assurance, and deployment methodologies. Agile development practices, for example, could be a plus.

Human Resources

The skills, capabilities, and effectiveness of the IT human resources are evaluated. This can include the development team, IT support, and management.

Compliance

Depending on the industry, the company may need to comply with certain regulations or standards, like GDPR for data protection or HIPAA for healthcare.

Future Potential and Roadmap

This is to understand what the company's future technology plans are and how they align with future trends and opportunities in the market, such as Generative AI.

IT Cost and Finance

A finance related viewpoint to cover major IT spend analysis, for suppliers, software, hardware, infrastructure etc set against current marketplace metrics.

Digital Presence

Understanding the company footprint in the digital realm. Social Media, Digital marketing, and advertising, Website, Mobile Applications etc.

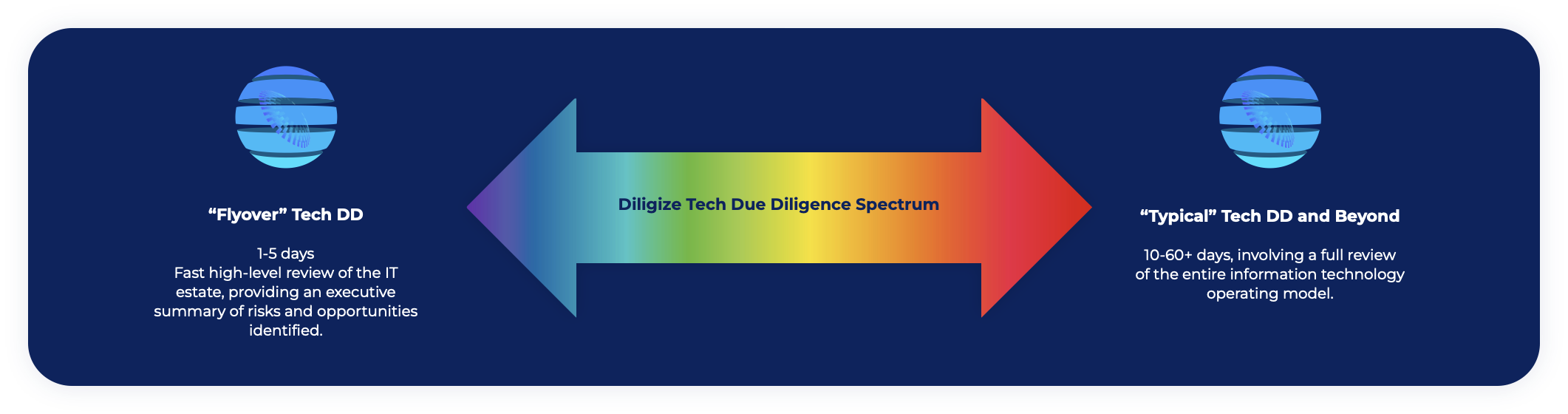

The importance of a flexible due diligence approach

Technology due diligence

The correct approach and scope to a technology due diligence project is the one that we decide to take together.

Many factors influence where on this spectrum a Tech DD engagement will naturally occur; factors such as technology estate size and maturity, recent acquisitions, bespoke applications in use, ongoing transformation programs, and others will influence the appropriate degree of engagement.

Additionally, clients and deal-teams may have specific requirements concerning how the analysis and results are presented, which is routinely offered as part of the engagement. This flexibility and client focus is part of the ongoing and overall commitment at Diligize to provide a flexible, well-considered, pragmatic engagement for technology due diligence.

Fees

Technology due diligence

Option 1: A “Fly-Over” (USD 5K)

Several Diligize experts deploy all their combined experience (usually 100+ years), in concert, for 1-5 days. Risks, issues and value-add opportunities are identified, leading to a high-level super summary report, including a walk-through, to explain the findings. There is typically no to very little paperwork available in this scenario, information discovery relying mainly on verbal engagement(s) with the target/client’s IT resources or wherever the knowledge can be found - a “Big 4” Tech DD Report may be available and would be reviewed and assessed.

Option 2: A “Typical” Buy/Sell-Side Tech DD (USD 10-30K)

Diligize experts will engage for 10-30 days, or until they are satisfied that the target/client technology operating model and business plan are very well understood. Risks, issues and value-add opportunities are identified. A detailed report (30-100+ slides), including a Super Summary, and a presentation walk-through is provided. Deal team support is provided all the way to deal completion.

The benefits of performing technology due diligence on a target company

Benefits of technology due diligence

Performing technology due diligence on a target company enables the private equity deal team to assess risks, determine valuation, evaluate operational efficiency, identify synergies, plan for exit strategies, and support post-acquisition integration. It provides crucial insights into the technology assets and their impact on the investment decision, value creation opportunities, and long-term success of the investment.

Risk Assessment

Technology due diligence helps identify potential risks and vulnerabilities associated with the target company's technology infrastructure, systems, and processes. It enables the deal team to assess the technology-related risks, such as cybersecurity threats, compliance issues, scalability challenges, or outdated systems, which can impact the value and success of the investment.

Valuation and Investment Decision

Technology due diligence provides insights into the value and growth potential of the target company's technology assets. It helps assess the scalability, competitive advantage, and market potential of the technology, which are critical factors in determining the valuation and investment decision. Understanding the technology's strengths and weaknesses assists in making informed investment choices.

Operational Efficiency

Evaluating the target company's technology infrastructure and systems helps assess its operational efficiency and effectiveness. Technology due diligence can uncover inefficiencies, bottlenecks, or areas where technology can be leveraged to optimize processes, reduce costs, and improve overall performance. Assessing the operational efficiency aids in identifying potential value creation opportunities.

Benefits Of technology due diligence

Synergy Identification

Technology due diligence allows the private equity deal team to assess the compatibility and potential synergies between the target company's technology and their existing portfolio companies or investment strategies. It helps identify opportunities for collaboration, integration, or leveraging technology across the portfolio, which can create additional value and strategic advantages.

Exit Strategy

Conducting technology due diligence also considers the future exit strategy. Understanding the technology assets, intellectual property, and market positioning helps in formulating a long-term plan for potential exits, whether through an IPO, strategic acquisition, or sale to another investor. Assessing the technology's attractiveness and market demand aids in determining the best exit path.

Post-Acquisition Planning

Technology due diligence supports post-acquisition planning and integration. It helps in developing a roadmap for integrating the target company's technology into the existing infrastructure or optimizing its technology operations. Assessing potential integration challenges and synergies allows the private equity deal team to develop a comprehensive plan for post-acquisition value creation.

Recent PE-related deals and engagements

Private equity funds